https://podcasts.apple.com/us/podcast/the-julia-la-roche-show/id1636372365

“It’s not just about making money during catastrophes…it’s about trying to protect ourselves from catastrophes”

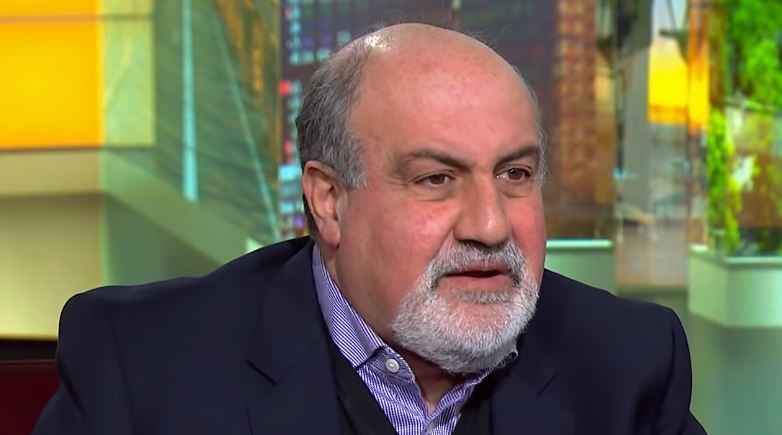

Nassim describes that most people prefer to sit on metaphorical dynamite for a steady stream of income. The primary goal at his firm Universa Investments is to benefit when the “steady” cashflow assets and trades cease to make money. Some things, like corporate profits, do not follow a bell curve and it is a mistake to make value judgments based on the bell curve that modern finance relies on.

“if you drive at 30mph, you’ll be okay… if you drive at 500mph, odds are you’re never going get there.” At a certain speed you become weak…staying below the speed at which you’re weak usually costs more time and money, however, is a necessary expense to prevent death (permanent loss)

“If I have cash in the bank, I am robust. I don’t have to predict the environment…we don’t need to understand why the market will crash…If you need to understand the environment, you’re already in trouble.”

Leave a Reply