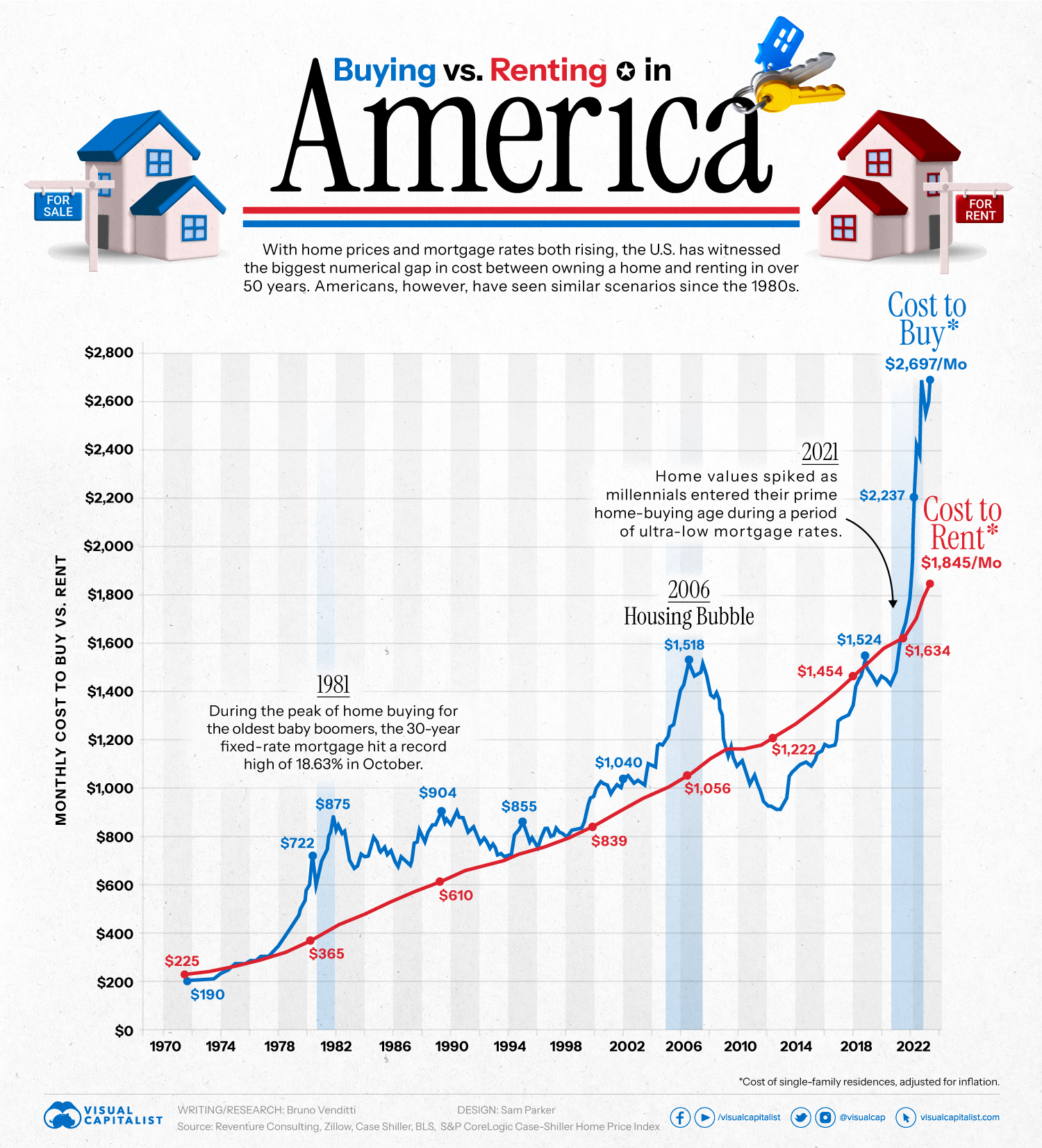

In August 2023, mortgage rates rose to the highest level in 23 years, with the national average 30-year fixed mortgage hitting 7.48%. With home prices and mortgage rates both rising, the U.S. is now witnessing the biggest numerical gap in the monthly cost between owning a home and renting in over 50 years. Today’s chart uses data from Reventure Consulting to highlight the cost of buying vs. renting a single-family residence in the U.S. since 1970, adjusted for inflation. Despite these positive signals, the full effects of rising interest rates may take time to filter through the economy. As a result, the median rent in America is approximately $1,850 per month, about 30% cheaper than the median cost to buy, standing at $2,700 per month. With this in mind, the following investments could help investors navigate interest rate uncertainty and mixed recession forecasts: Value equities: Historically have more stable earnings than growth equities. Recently, the Federal Reserve unveiled new projections, indicating that the interest rate could potentially reach 5.6% by the end of 2023, implying at least one more rate hike in 2023. Soft landing: The Federal Reserve raises interest rates just enough to stabilize inflation. Pairing longer-dated and short-dated bonds: This type of bond strategy allows for investors to pivot if interest rates change, and to lock-in higher rates over longer horizons.

Buyer Beware!

by

Tags: