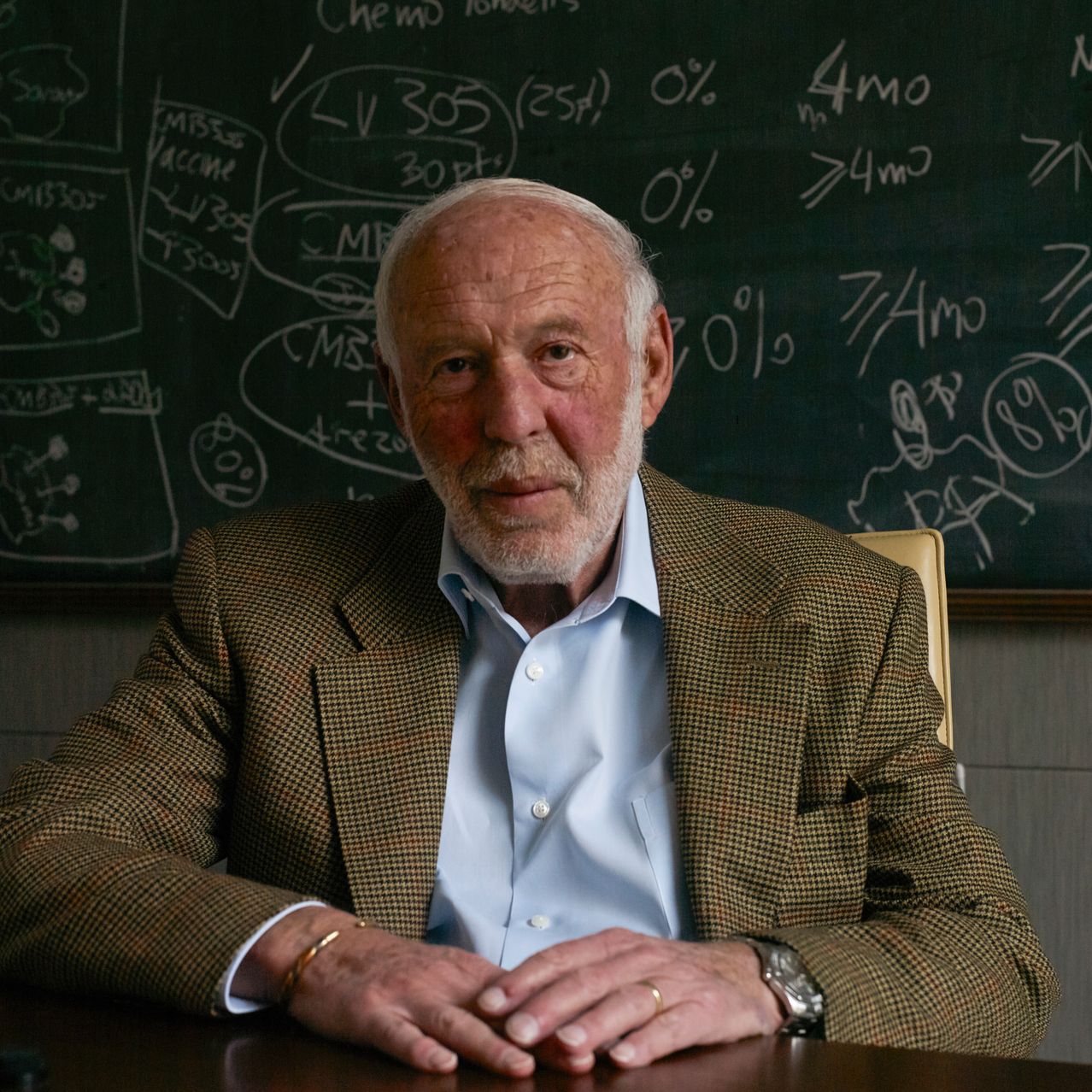

“How a Mathematician Became the Greatest Trader of All Time,” Jim Simons, the founder of Renaissance Technologies and its successful Medallion hedge fund, is profiled. Simons, a mathematician and code-breaker, took a scientific approach to investing, using vast data sets, computer models, and algorithms. His strategies, which challenged traditional intuition-based investing, led to average annual returns of 66% for 30 years, turning $100 into $398.7 million today. Despite early challenges and personnel changes, Renaissance continued to improve its algorithms and recruit skilled mathematicians, culminating in a successful automated stock trading system in the mid-1990s. Despite being a private hedge fund, Renaissance’s success earned it the nickname “Renaissance Riviera” and has influenced Wall Street to invest in technology and AI for competition.

The Greatest Active Manager Ever

Posted

in

by

Tags: