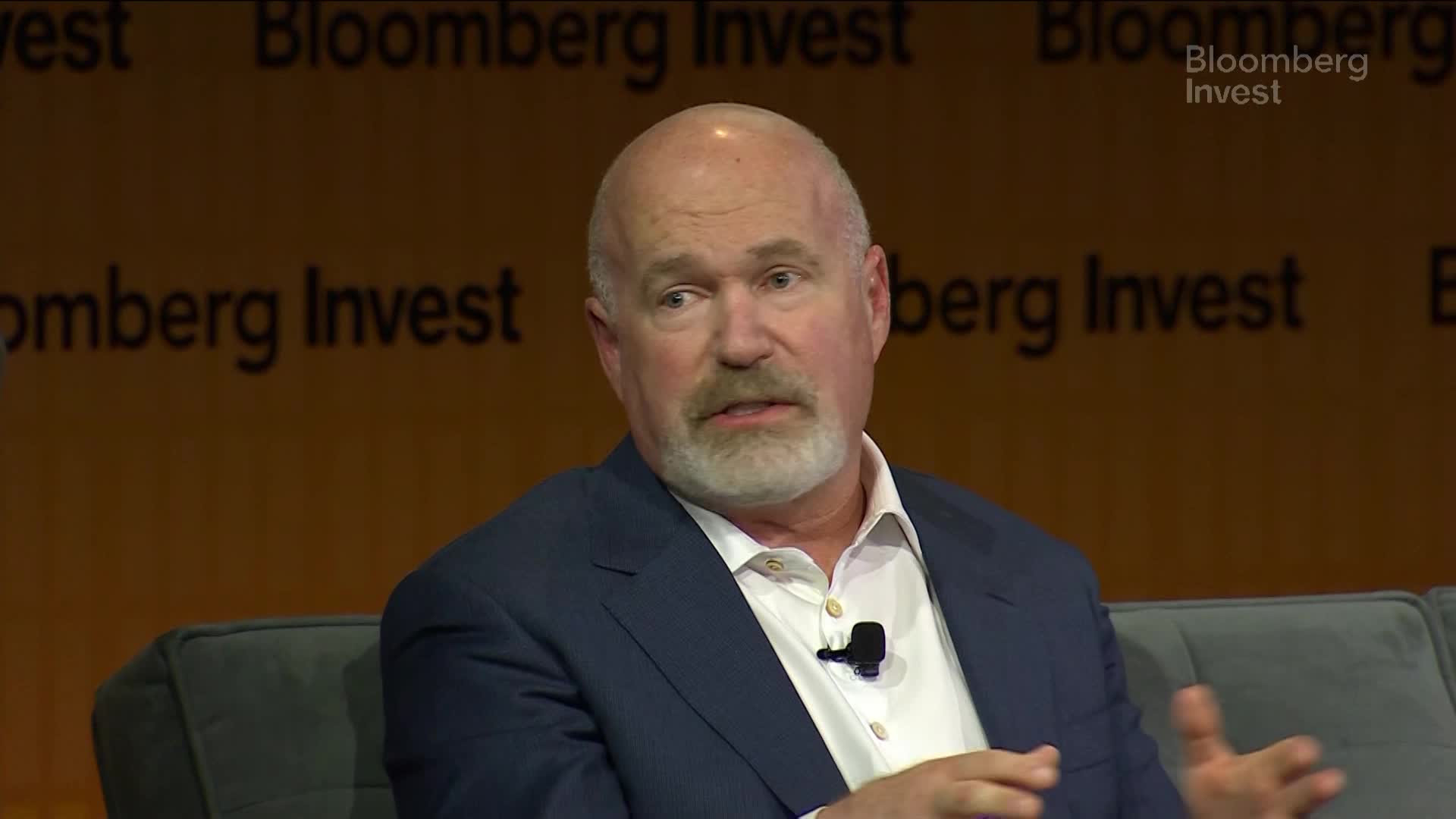

Cliff Asness, founder of AQR Capital Management, discusses his views on market efficiency. Asness recalls his experience in Eugene Fama’s efficient market theory class, where he learned that markets are not perfectly efficient, causing a gasp among students. He explains that while markets are more efficient than he believes, perfect efficiency is an unrealistic concept. Asness shares his observation that markets have become less efficient over his 32-year career, citing the dot-com bubble as an extreme example. He notes that the market’s disconnection from reality has grown more pronounced in recent years, with price multiples and quality reaching levels beyond the tech bubble.

AQR’s Portfolio: