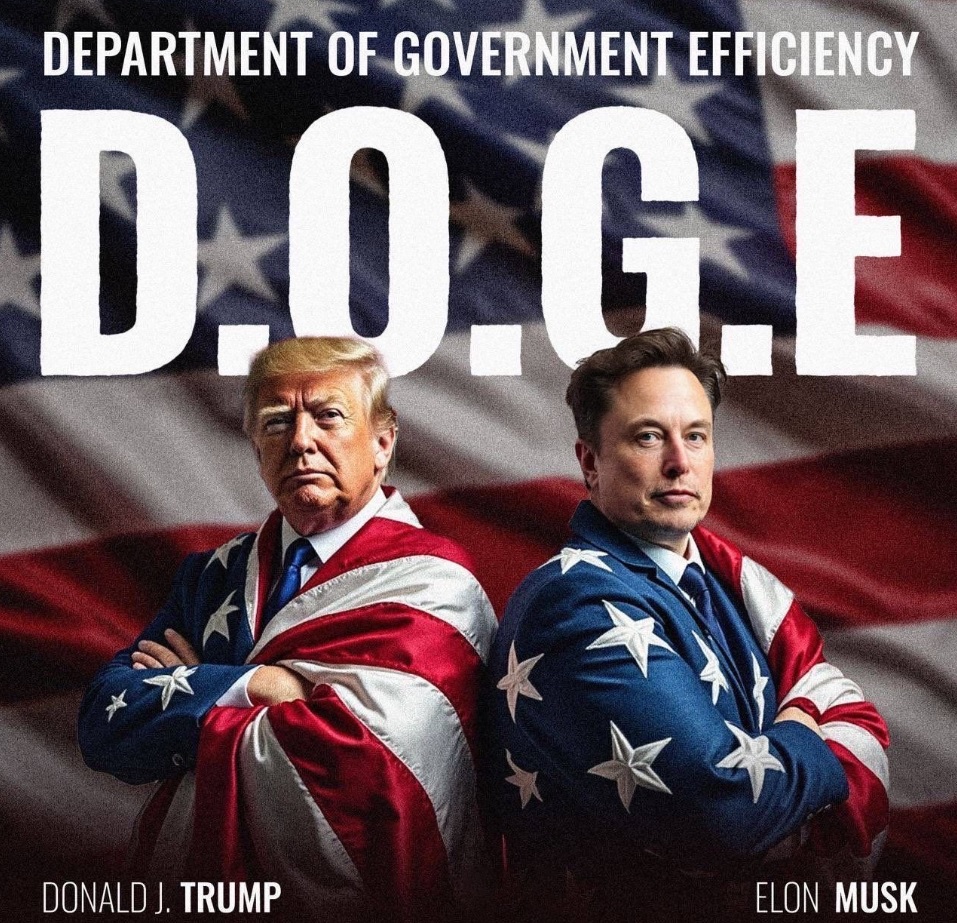

Trump, Elon, and a few others now face a moral and ethical dilemma about what to do with their businesses. Check out my conversation with ChatGPT

Greg

Why did hank paulson not pay taxes on his goldman sachs stock before becoming a government official

ChatGPT

Henry “Hank” Paulson was legally exempt from paying capital gains taxes on his Goldman Sachs stock when he became the U.S. Treasury Secretary in 2006. This tax exemption stems from a U.S. tax law provision designed to reduce financial conflicts of interest for individuals transitioning from private sector positions into public service.

Under Section 1043 of the Internal Revenue Code, a government official can defer capital gains taxes on assets they are required to divest to comply with ethics regulations, provided they reinvest in “qualified” replacement assets, such as broad-based mutual funds, government bonds, or diversified exchange-traded funds (ETFs). The law’s goal is to allow high-level appointees to sell assets that could create conflicts of interest without the financial disincentive of a significant tax burden.

In Paulson’s case:

1. **Required Sale**: He had to divest his stake in Goldman Sachs to avoid any conflict of interest given the Treasury Department’s regulatory role over financial institutions.

2. **Tax Deferral Opportunity**: By reinvesting the proceeds in other qualified assets, he took advantage of the tax deferral, avoiding an estimated $50 million in capital gains taxes he would have owed on his approximately $500 million in stock holdings.

The law encourages qualified individuals to enter public service without worrying about tax penalties from divesting significant personal assets, which can be crucial when those assets involve substantial capital gains.

Greg

Which public service position could elon musk be offered in which he is able to defer almost all cap gains

Chatgpt

If Elon Musk were to be appointed to a high-level federal government position, such as a Cabinet position (e.g., Secretary of Energy, Commerce, or Defense), he could potentially defer capital gains taxes on a large portion of his holdings, such as his stakes in companies like Tesla, SpaceX, and others, under **Section 1043 of the Internal Revenue Code**. This provision applies to federal employees required to divest holdings to avoid conflicts of interest.

### Key Positions That Could Qualify for Tax Deferral

1. **Cabinet Secretary**: Positions like Secretary of Energy or Commerce, where Musk’s expertise in technology, energy, and infrastructure might align with government initiatives, would qualify under the tax deferral rules. The President would need to nominate and the Senate would confirm him.

2. **Senior Advisor** or **Special Envoy**: While not a Cabinet post, other senior executive roles—especially those involving economic, technological, or defense-related issues—might also require divestiture of holdings if potential conflicts exist. These roles would need a determination that divestiture is required, but they could still be eligible under Section 1043.

3. **White House Position**: Serving as an advisor in the White House on technology or economic policy could also require divestment of certain holdings. The scope of this depends on conflict of interest determinations but could potentially include Section 1043 eligibility.

### Mechanism of the Tax Deferral

Upon assuming such a federal role, Musk would:

1. **Sell the Conflicting Assets**: Required assets (e.g., Tesla shares) would be sold to eliminate conflicts of interest.

2. **Reinvest in “Qualified” Assets**: He could defer capital gains taxes by reinvesting in diversified mutual funds, Treasury bonds, or ETFs.

3. **Avoid Immediate Tax Liability**: Capital gains taxes would be deferred until he sells these replacement assets, at which point the deferred gains would be realized unless he executed additional tax strategies.

### Example: Deferral Potential for Musk’s Wealth

– Assuming he sold $100 billion in Tesla shares at a 15-20% capital gains rate, tax deferral could initially save Musk between $15 billion and $20 billion in immediate capital gains taxes.

This provision, designed to encourage high-level talent to enter public service without incurring huge tax costs, has faced scrutiny because it benefits individuals with substantial capital gains. However, it remains a legitimate path under current U.S. tax law, and it has been used by wealthy appointees across several administrations.

For Musk, who holds concentrated stakes with immense gains, this deferral could represent a significant immediate tax advantage.

GREG

What are the largest dangers of a plutocratic executive branch and what happens if the legislative branch is the same party as the executive. Does the constitution adequately guard us from a plutocratic takeover?

ChatGPT

A plutocratic executive branch, where the primary influence comes from extremely wealthy individuals or groups, presents serious risks to the principles of democratic governance. When the executive and legislative branches are both controlled by the same party, these dangers can intensify if institutional checks and balances weaken under the influence of concentrated wealth and aligned political interests.

Here are the primary risks and constitutional considerations:

1. Risks of a Plutocratic Executive Branch

- Policy Capture: Wealthy interests can shape policy to favor their agendas, potentially at the expense of the public. This could include deregulation that benefits large corporations, tax cuts that disproportionately favor the wealthy, or even shifts in foreign policy to align with specific economic interests.

- Erosion of Democratic Accountability: When wealthy individuals exert control over the executive branch, government transparency can suffer, and accountability mechanisms may weaken. This can create a “pay-to-play” environment where only those with significant resources have influence.

- Reduction in Economic Mobility: Policy decisions driven by plutocratic influence may further entrench wealth inequality by favoring policies that maintain or expand wealth gaps, reducing opportunities for economic mobility.

- Undermining of Public Trust: A government seen as plutocratic may lose legitimacy in the eyes of citizens, undermining public trust and participation. This cynicism can lead to apathy, disenfranchisement, and reduced voter turnout, creating a cycle that perpetuates plutocratic control.

2. Dangers When the Legislative and Executive Branches Align

- Weakening of Checks and Balances: When the executive and legislative branches are controlled by the same party, the potential for meaningful oversight diminishes, especially if both branches prioritize shared interests over their constitutional duty to serve as checks on one another.

- Ease of Passing Favorable Legislation: A unified government can push through policies favoring wealthy interests without significant opposition, especially if legislative leaders are also influenced by plutocratic forces. This could lead to large-scale deregulation, tax policies favoring the wealthy, and reduced social spending.

- Judicial Appointments: With control over the legislative and executive branches, a plutocratic government could appoint judges sympathetic to their interests, impacting judicial independence and decisions on issues like campaign finance, regulatory power, and voting rights.

- Increased Centralization of Power: When both branches align under a plutocratic influence, decision-making power centralizes, reducing democratic input and making it harder for ordinary citizens to influence policy through traditional legislative advocacy.

3. Constitutional Safeguards Against Plutocracy

The U.S. Constitution does provide certain mechanisms to prevent the takeover of the government by plutocratic interests, though there are limitations and gaps, especially given recent legal interpretations:

- Separation of Powers: The Constitution’s separation of powers is designed to prevent any single branch or group from consolidating too much control. However, this requires each branch to function independently and hold the others accountable, which becomes difficult if political alliances or plutocratic influence weakens these divisions.

- Checks and Balances: The ability of each branch to check the others (e.g., veto power, judicial review, congressional oversight) provides theoretical barriers to unrestrained plutocratic control. These checks are only effective if there is active and genuine opposition to plutocratic policies, which weakens under unified control.

- The Electoral System: Frequent elections theoretically allow the public to remove representatives who cater too heavily to plutocratic interests. However, campaign finance laws (especially after Citizens United v. FEC) allow for significant corporate and wealthy donor influence, which can skew elections and reinforce plutocratic control.

- The First Amendment and the Press: A free press is a critical check on government power. Investigative journalism can expose plutocratic influence, rally public opposition, and create political consequences for overt plutocratic behavior. However, concentrated ownership of media and information can weaken this check.

- Impeachment: Impeachment allows Congress to remove officials, including the president, for abuses of power. However, this requires a majority in the House and a two-thirds Senate majority, making it difficult if plutocratic influence aligns both chambers with the executive branch.

4. Limitations and Potential Vulnerabilities

- Campaign Finance Loopholes: The Constitution does not explicitly regulate campaign finance, and current interpretations (e.g., Citizens United) protect substantial financial influence under the First Amendment, allowing plutocrats to fund campaigns and influence elections with minimal restriction.

- Lack of Direct Anti-Plutocracy Provisions: The Constitution lacks explicit safeguards against the concentration of economic power or wealth-based governance, making it largely dependent on the ethical conduct of elected officials and the vigilance of voters.

- Partisan Appointments to the Judiciary: If a plutocratically influenced executive and legislature successfully appoint a judiciary sympathetic to their interests, it can have long-lasting impacts, as judicial interpretations of constitutional protections may increasingly favor wealthy interests.

5. Additional Safeguards and Reforms (Speculative and Reform-Oriented)

- Campaign Finance Reform: Proposals to limit the influence of money in politics, such as public financing of campaigns or limits on super PAC contributions, could reduce plutocratic influence. Legislative reform in this area faces legal challenges under current First Amendment interpretations but could still be pursued.

- Transparency Laws: Increasing transparency requirements for campaign finance, lobbying, and government contracts could expose plutocratic influences and provide voters with critical information, though these too depend on legislative will and enforcement.

- Judicial Term Limits: Lifetime appointments can entrench partisan influence. Term limits for judges could reduce long-term plutocratic impact on the judiciary.

Final Analysis

While the Constitution provides a framework intended to prevent undue concentrations of power, it is not fully equipped to prevent a plutocratic takeover, especially if influence infiltrates all branches of government. The framers relied on informed and active citizen participation, expecting that regular elections, freedom of the press, and robust checks and balances would prevent such control. However, modern campaign finance, concentrated media ownership, and polarized parties create vulnerabilities. Active reform efforts and vigilant public engagement are thus essential to bolstering these constitutional protections against plutocracy.