One factor is the high demand for affordable transportation, which led to older cars becoming valuable commodities instead of being scrapped. As a result, there are fewer average cars available for the middle class. The high-price, high-margin models received first priority and pick of the limited semiconductors supply sourced from China.

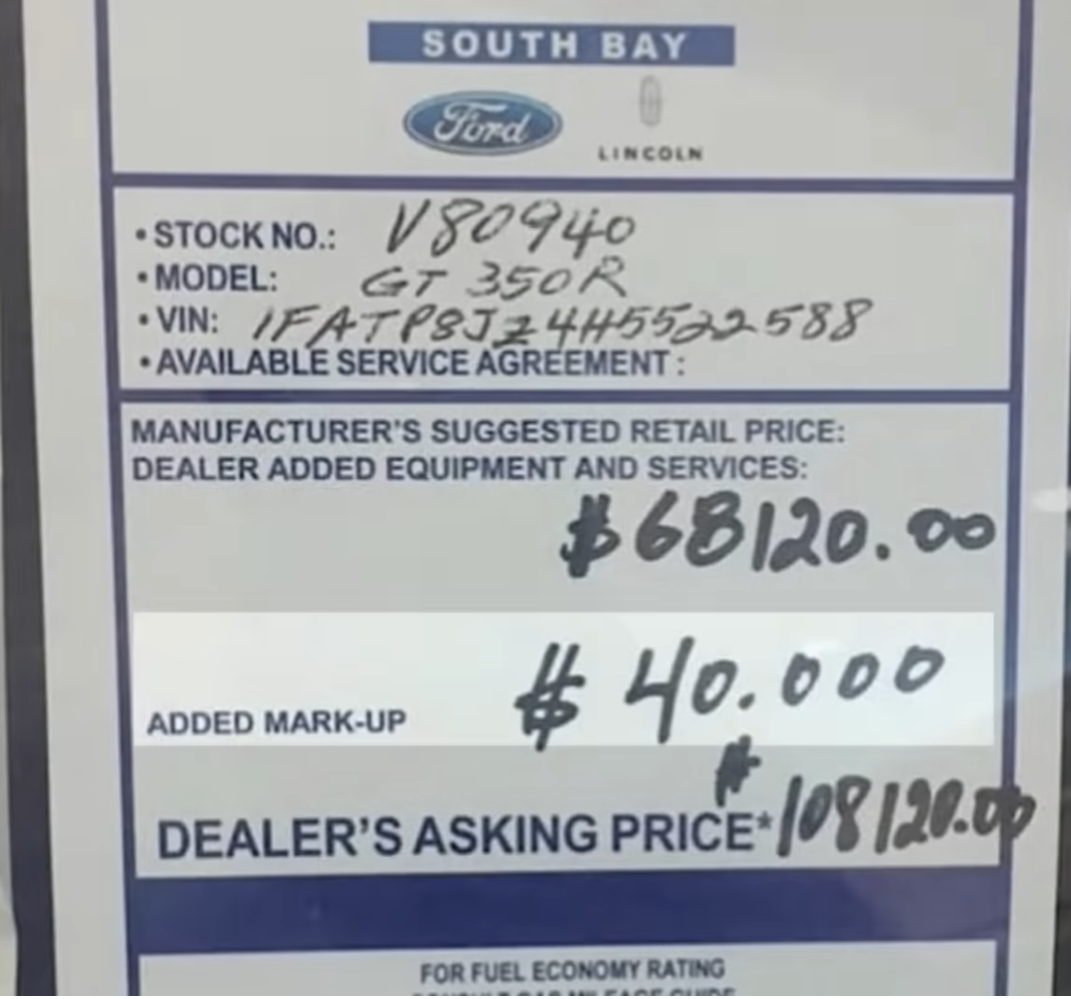

Car manufacturers and dealers enjoyed higher profits from high-priced models. Bureau of Labor and Statistics claims dealer markups accounted for 30-62% of car price inflation. Additionally, the average monthly payment for new and used cars has risen more than 100 dollars per month, making it challenging for consumers to afford these payments, especially with higher interest rates.

Transunion says average car payments are $736 per month for new cars and $523 for used cars. Availability of credit has decreased, causing lenders to worry about loan sizes surpassing the value of the cars securing the loans. Furthermore, the unsold inventory of high-spec trucks and the pressure on disposable income for consumers. Also discussed is the rise in vehicle repossessions and the increasing costs of auto insurance, attributed to more expensive cars and higher repair and replacement part costs.

Leave a Reply