Category: AAPL

-

Market Update

Corporate Investments and GrowthApple’s $600 billion US investment over 4 years faces skepticism due to its existing $55 billion annual investment in China, where 90% of its products are manufactured. Palantir’s quarterly sales reached $1 billion, growing 47% with $306 million in commercial revenue and $426 million from US government contracts, primarily defense and CIA.…

-

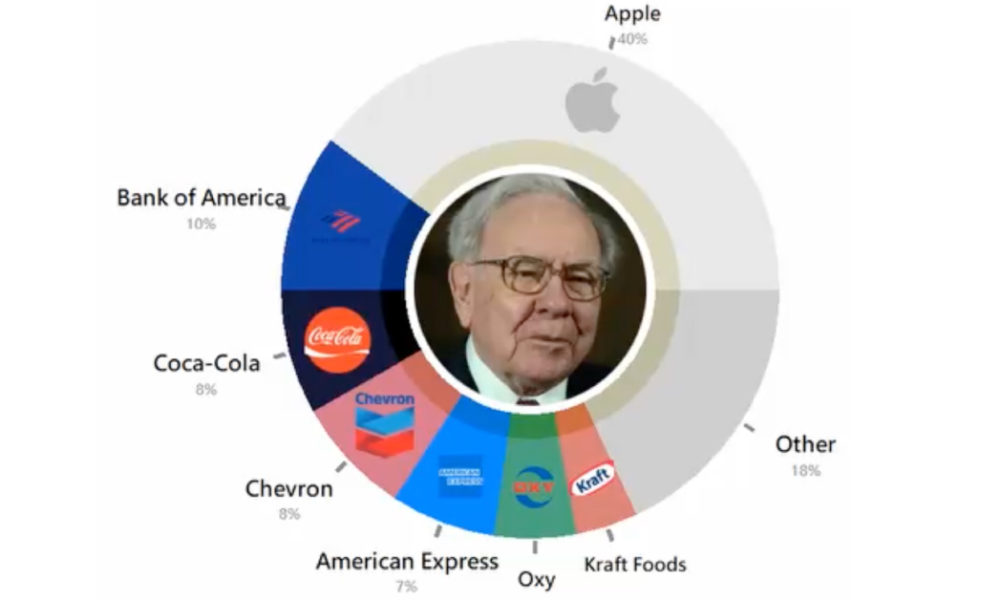

Why 2% Succeed. Lessons from Warren Buffett

Buffett expresses his belief in investing only in things he understands and shares his experience with evaluating businesses based on their economic characteristics. He uses examples of industries like automobiles and airplanes to illustrate how difficult it is to predict winners and emphasizes the importance of understanding the economic consequences of a business. Buffett shares…

-

VIX Explosion

Yen Carry Trade Deep Dive,” Brent Johnson discusses the concept of a carry trade and how Japan’s zero or negative interest rates for decades have made the Japanese Yen an attractive currency for this investment strategy. However, when the currency starts to appreciate or interest rates rise, the cost of carry can exceed the return, leading…

-

Buffett Locking in Gains

Buffett clarified that this does not reflect a change in view towards Apple’s business or investment attractiveness. Berkshire considers various factors, including tax implications and manager responsibility, when deciding on stock investments. Buffett emphasized that they do not attempt to predict markets or pick stocks based on trends but view them as businesses to serve…