Category: Banking

-

Farms

The Farm Crisis examines the tragic circumstances faced by farmers for most of the 1980s, when thousands were forced into bankruptcy, land values dropped by one-third nationally, and sky-high interest rates turned successes into failures seemingly overnight. Gov. Terry Branstad, Sen. Charles Grassley, Sen. Tom Harkin, former Rep. Jim Leach, the late Mark Pearson, former…

-

Fed Chair vs. The World

Speech starts at 10:45 Jerome H. Powell, Chair of the Federal Reserve, addresses the Economic Club of Chicago, discussing the current economic outlook and the Fed’s dual mandate of maximizing employment and ensuring price stability. Powell outlines the resilience of the U.S. economy despite heightened uncertainties, acknowledging challenges arising from trade policy changes, inflation concerns linked…

-

What Causes Recessions

The four major theories of business cycles in relation to the Great Recession of 2008: Keynesian theory, real business-cycle theory, monetarist approaches, and the Austrian School of Economics. Each theory offers a unique perspective on the causes of the recession. Keynesian economics attributes the recession to a shortfall in aggregate demand, while real business-cycle theorists…

-

In Bessent’s Words…

Bottom line: rate cuts, banking deregulations, or any kind of stimulus package are not coming anytime soon Bessent’s interview with Tucker Carlson reaffirmed a lot of views that many of us already held—but I think it’s worth highlighting a few key points that are particularly relevant. First, they’re 100% serious about addressing the wealth imbalance.…

-

John Collison

John Collison on the growth of electronic payments, fundraising, and unicorns staying private

-

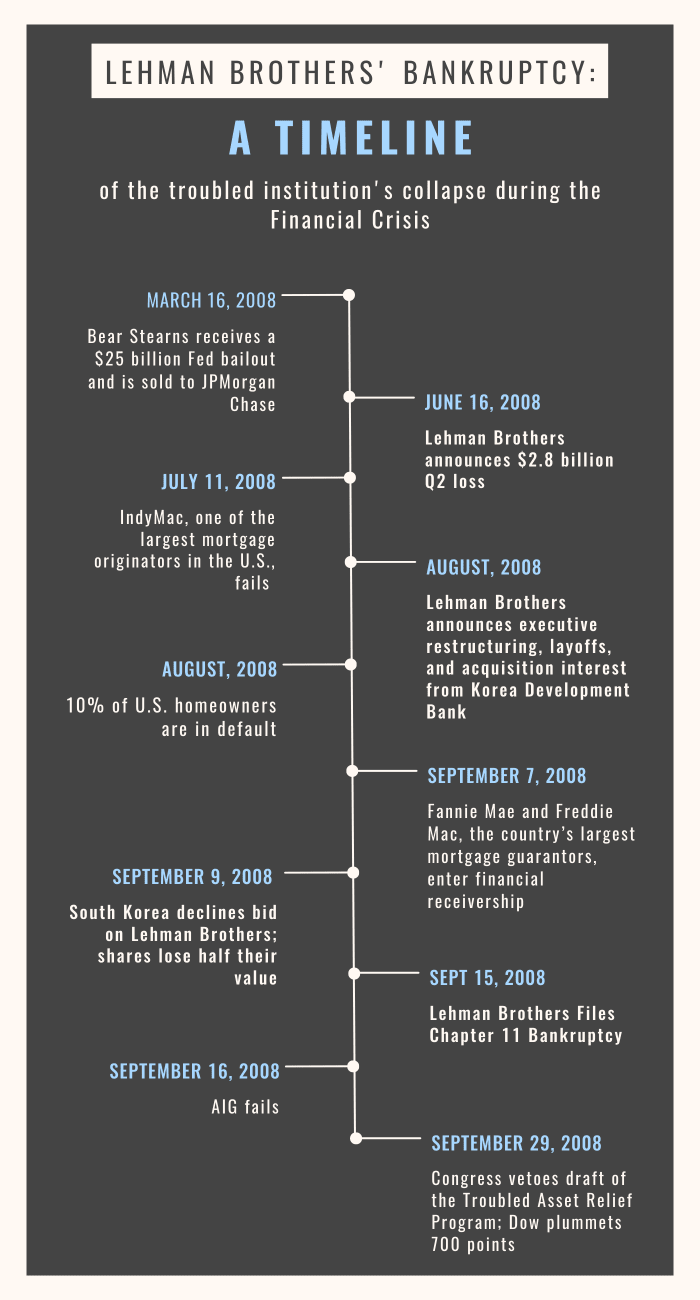

Lehman Bros

Wall Street during the early 2000s, with a focus on Lehman Brothers, one of the oldest and most aggressive investment banks. The mortgage industry saw significant growth due to securitization and government encouragement of homeownership, leading to the bundling and selling of mortgage contracts to institutional buyers worldwide. Lehman’s executives, such as Anthony Fry and…

-

Allen Stanford

I didn’t know the story of Allen Stanford before seeing this video. He created a Ponzi scheme worth over $5 billion and ended up with a 110year prison sentence. Despite his public image as a trustworthy banker, Stanford’s life was built on lies, starting with his humble beginnings in Texas. He went on to live a…

-

With Flying Colors…

The spectacular results of the Federal Reserve’s stress tests on the eight largest banks. Every single one of the top 31 banks passed the tests despite holding more consumer credit card loans and corporate debt, with elevated delinquency rates and retail giants reporting that consumers are tapped out. The Fed also performed an exploratory analysis…