Category: Banking

-

Fed Cuts?

-

America’s Economy

“Why JPMorgan CEO Jamie Dimon Is Skeptical of an Economic Soft Landing | WSJ” YouTube video interview, Dimon expresses his concerns about the economic outlook, citing potential inflation, higher interest rates, and geopolitical tensions as significant threats. He is cautious about a soft landing and shares his thoughts on the infrastructure bill and Jerome Powell’s…

-

Manufacturing Slowdown?

A notably conservative panel Kevin O’Leary, Kevin Hassett, and John Carney discuss inflation, bank failures and credit card delinquencies. They attribute seasonal issues and the possibility of trend reversal to these issues, but note ongoing struggles like a capex slowdown and small business borrowing challenges. They also discuss rising credit card and automobile loan delinquencies…

-

Real Estate Trainwreck?

Chris Whalen’s YouTube video titled “Commercial Real Estate ‘Trainwreck’ Will Hit Banking System In 2024,” the banking expert discusses the challenges facing the banking industry due to commercial real estate loans. Whalen predicts that losses from commercial real estate workouts could impact bank earnings significantly. He compares the current situation to the oil patch crisis in…

-

Bank Failure: Worst since 2008

“The worst year for banks since 2008 | FT Film” discusses the tumultuous year experienced by the global banking sector in 2023, which was deemed the worst year for banks since the 2008 financial crisis. The video explores various events such as the collapse of Silicon Valley Bank (SVB) due to the decline in funding for tech…

-

Gundlach’s 2024 Predictions

Jeffrey Gundlach discusses the most surprising things he observed in 2023. He was surprised by the continuation of the market’s momentum in consumer spending despite the high interest rates on credit cards. He also commented on the surprising drop in the commodity price complex, including the issue with the Mid-East oil and the slowing global…

-

Bank of America Losses

131.6 Billion. Ouch

-

A Serious Message From Buffett

Warren Buffett’s recent decisions to sell stocks (33B in last 3 quarters) and increase cash reserves ( to$147B), combined with Michael Burry’s options bet against the market, suggest concerns about a possible recession in the US economy. Factors such as persistent inflation, high gas prices, global instability, the AI boom, troubles in commercial real estate,…

-

Short Selling, Hope, and Reddit

Marije Meerman’s final chapter in her series on trading discusses the challenges and risks of short selling in the financial market. They point out that while being proved right as a short seller is possible, it can also be a lonely and daunting task. Ultimately short selling is just a small part of the larger…

-

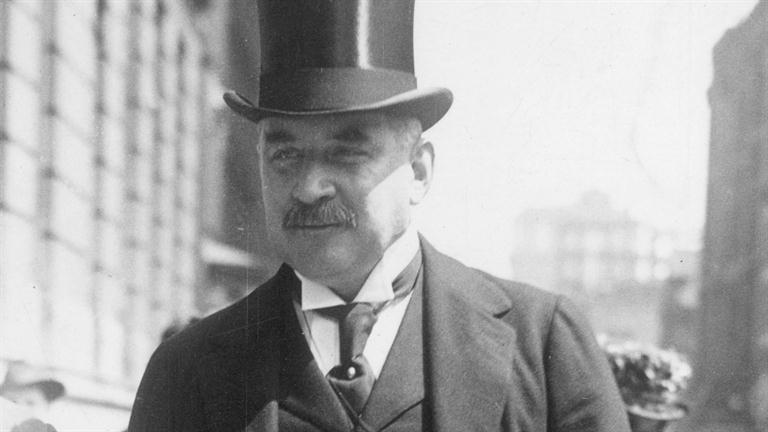

This Man Saved the U.S. From Ruin