Category: Banking

-

Should the fed declare victory?

Jeff Gundlach notes Import and Export prices, are looking encouraging. However, he also mentions that these prices are currently in negative double digits compared to previous years, indicating disinflationary pressure. Gundlach believes that the massive stimulus and economic distortions from 2020 and 2021 have led to inflation, which is still bubbling through the system. He…

-

Bianco Predicts…

The Magnificent Seven stocks (FANG stocks, plus Tesla, Microsoft, and Nvidia) have contributed significantly to the overall market gains. Bianco attributes their success to the hype around artificial intelligence and the rollout of new technologies. However, he also notes that the performance of the other 493 stocks in the S&P 500 has been less impressive,…

-

Soft Landing

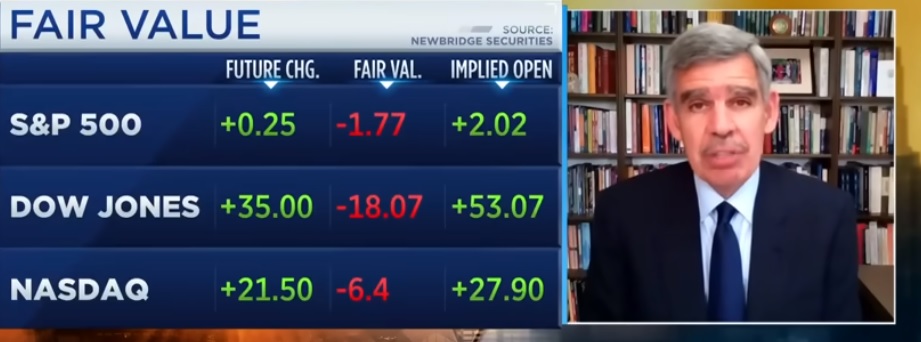

Mohamed El-Erian, former CEO and current academic and economic adviser, thinks that a soft landing narrative in the economy, combined with *money on the sidelines*, is driving the current rally. El-Erian acknowledges the bearish sentiment among investors but believes good earnings numbers could bring some back. *reminder…there is no such thing as money on the…

-

Big Bank President?

He suggests that the country’s lackluster economic growth can be attributed to shortcomings in areas such as immigration, taxation, mortgages, affordable housing, and healthcare. Dimon also discusses the need for better education and expanding the Earned Income Tax Credit as a form of industrial policy to improve social outcomes. While Dimon acknowledges his interest in…

-

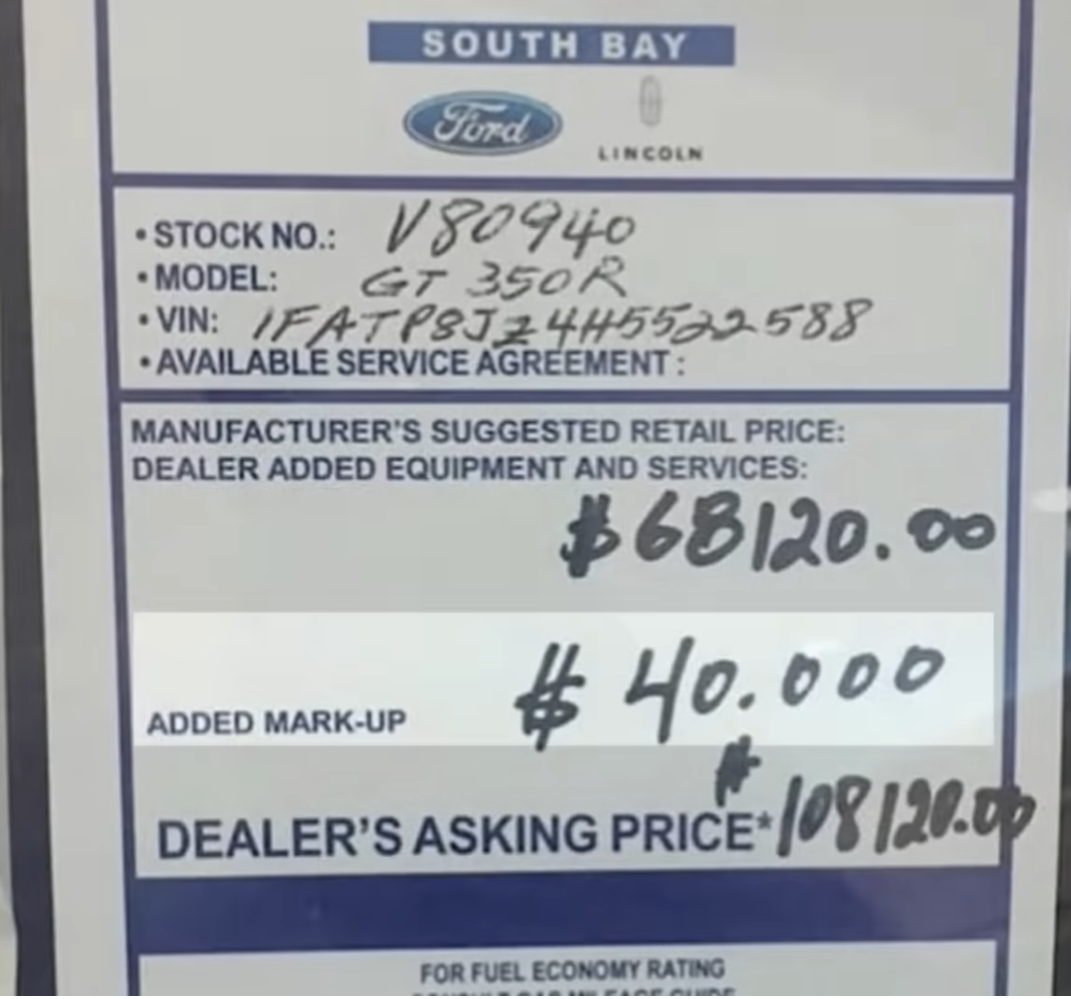

Car inflation….

One factor is the high demand for affordable transportation, which led to older cars becoming valuable commodities instead of being scrapped. As a result, there are fewer average cars available for the middle class. The high-price, high-margin models received first priority and pick of the limited semiconductors supply sourced from China. Car manufacturers and dealers…

-

Griffin at Goldman

-

Commercial Real Estate

1.4 trillion of commercial debt is coming due in the US alone, and with the cost of borrowing being up and the value of buildings down, refinancing may not be possible for some. Many banks, lenders, and owners have to decide what to do as it is unclear how much further down it will go.…

-

Balaji Panics….

Balaji Srinivasan discusses the recent financial crisis and compares it to the one that happened in 2008. He explains that over the course of 2021, many people were saying that inflation was going to happen, but the Federal Reserve continued to sell hundreds of billions of dollars in bonds during this period. However, in December…

-

6/12/23

Nassim Taleb, hedge fund manager and author of “The Black Swan” discusses the limitations of financial models. He argues that most of the world is driven by Fat-Tailed processes and that using normal distributions in risk analysis is not accurate. Taleb explains that Modern Portfolio Theory, which uses a mix of stocks and bonds, does…