Category: Recession

-

Farms

The Farm Crisis examines the tragic circumstances faced by farmers for most of the 1980s, when thousands were forced into bankruptcy, land values dropped by one-third nationally, and sky-high interest rates turned successes into failures seemingly overnight. Gov. Terry Branstad, Sen. Charles Grassley, Sen. Tom Harkin, former Rep. Jim Leach, the late Mark Pearson, former…

-

What Causes Recessions

The four major theories of business cycles in relation to the Great Recession of 2008: Keynesian theory, real business-cycle theory, monetarist approaches, and the Austrian School of Economics. Each theory offers a unique perspective on the causes of the recession. Keynesian economics attributes the recession to a shortfall in aggregate demand, while real business-cycle theorists…

-

In Bessent’s Words…

Bottom line: rate cuts, banking deregulations, or any kind of stimulus package are not coming anytime soon Bessent’s interview with Tucker Carlson reaffirmed a lot of views that many of us already held—but I think it’s worth highlighting a few key points that are particularly relevant. First, they’re 100% serious about addressing the wealth imbalance.…

-

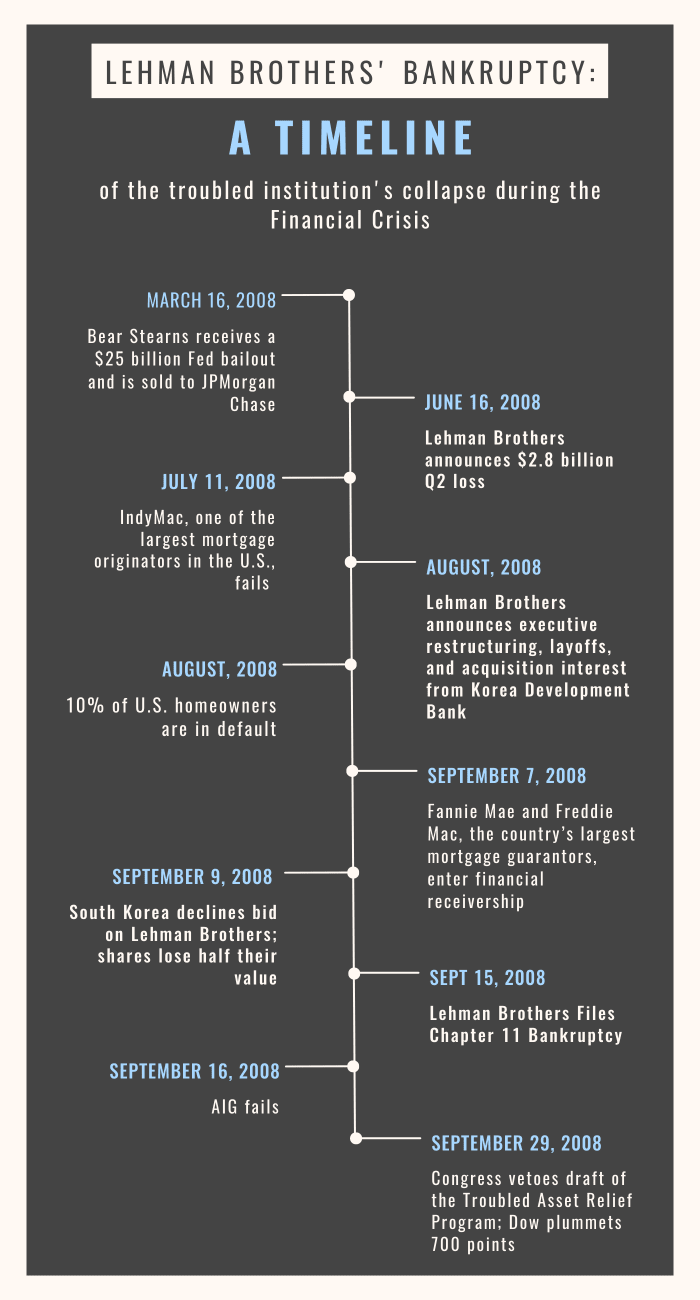

Lehman Bros

Wall Street during the early 2000s, with a focus on Lehman Brothers, one of the oldest and most aggressive investment banks. The mortgage industry saw significant growth due to securitization and government encouragement of homeownership, leading to the bundling and selling of mortgage contracts to institutional buyers worldwide. Lehman’s executives, such as Anthony Fry and…

-

Fed Cuts?

-

America’s Economy

“Why JPMorgan CEO Jamie Dimon Is Skeptical of an Economic Soft Landing | WSJ” YouTube video interview, Dimon expresses his concerns about the economic outlook, citing potential inflation, higher interest rates, and geopolitical tensions as significant threats. He is cautious about a soft landing and shares his thoughts on the infrastructure bill and Jerome Powell’s…

-

Gundlach’s 2024 Predictions

Jeffrey Gundlach discusses the most surprising things he observed in 2023. He was surprised by the continuation of the market’s momentum in consumer spending despite the high interest rates on credit cards. He also commented on the surprising drop in the commodity price complex, including the issue with the Mid-East oil and the slowing global…

-

A Serious Message From Buffett

Warren Buffett’s recent decisions to sell stocks (33B in last 3 quarters) and increase cash reserves ( to$147B), combined with Michael Burry’s options bet against the market, suggest concerns about a possible recession in the US economy. Factors such as persistent inflation, high gas prices, global instability, the AI boom, troubles in commercial real estate,…

-

Short Selling, Hope, and Reddit

Marije Meerman’s final chapter in her series on trading discusses the challenges and risks of short selling in the financial market. They point out that while being proved right as a short seller is possible, it can also be a lonely and daunting task. Ultimately short selling is just a small part of the larger…

-

This Man Saved the U.S. From Ruin