Category: Berkshire Hathaway

-

Mike Green on “Passive”

The causes, risks, and future related to passive investing and its influence on the markets. In summary Mike has quantified 1) the effects of regulatory and QDIA changes as well as 2) value managers being fired and passive managers being hired. https://www.simplify.us/leadership

-

Li Lu

Li Lu and Charlie Munger and Warren Buffett,” the speaker shares experiences and insights from meetings and mentorships with Charlie Munger and Warren Buffett. Munger, initially perceived as distant, provided valuable advice and encouraged long-term investment strategies. Buffett admired Munger’s ability to understand complex businesses and expand his investment horizons. Li Lu, a Chinese businessman,…

-

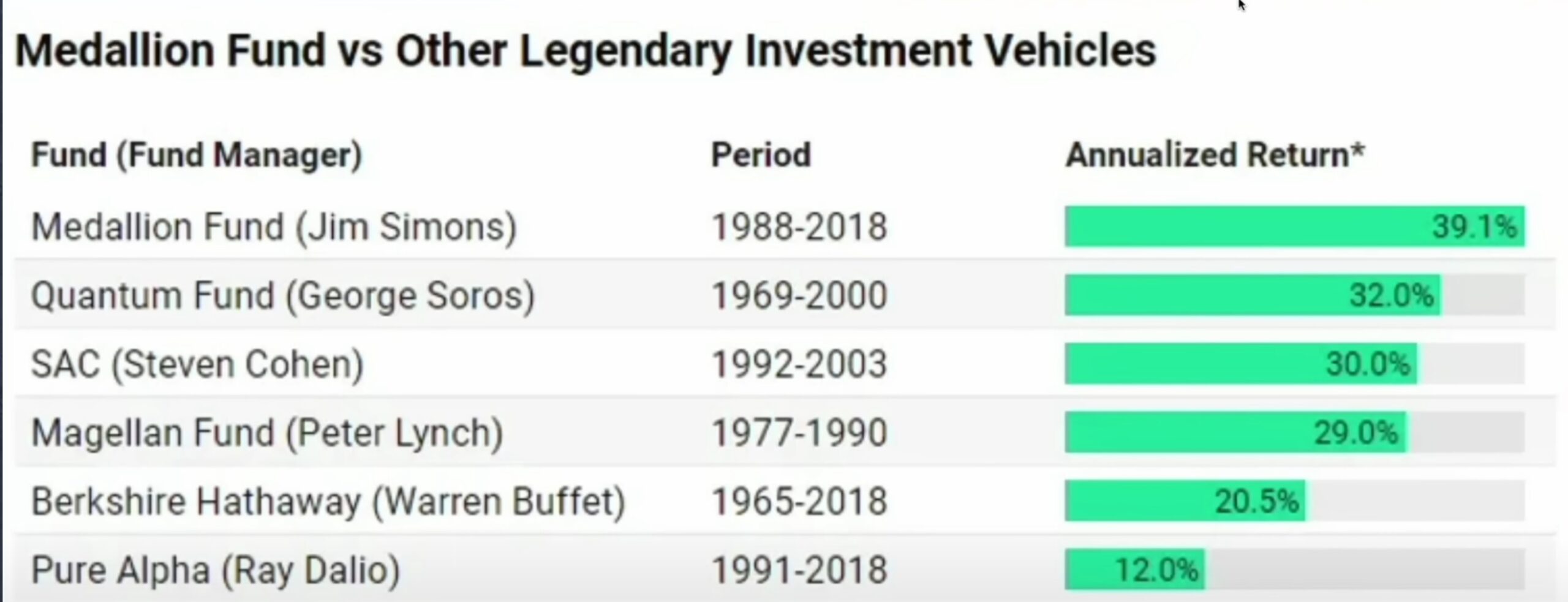

39% After Fees…

More on Jim Simons vs other great traders and investors. Also explained (by Charlie Munger) is why Medallion is/was not able to scale past 10B in AUM and some built in promo for Patrick Bet David products and services.

-

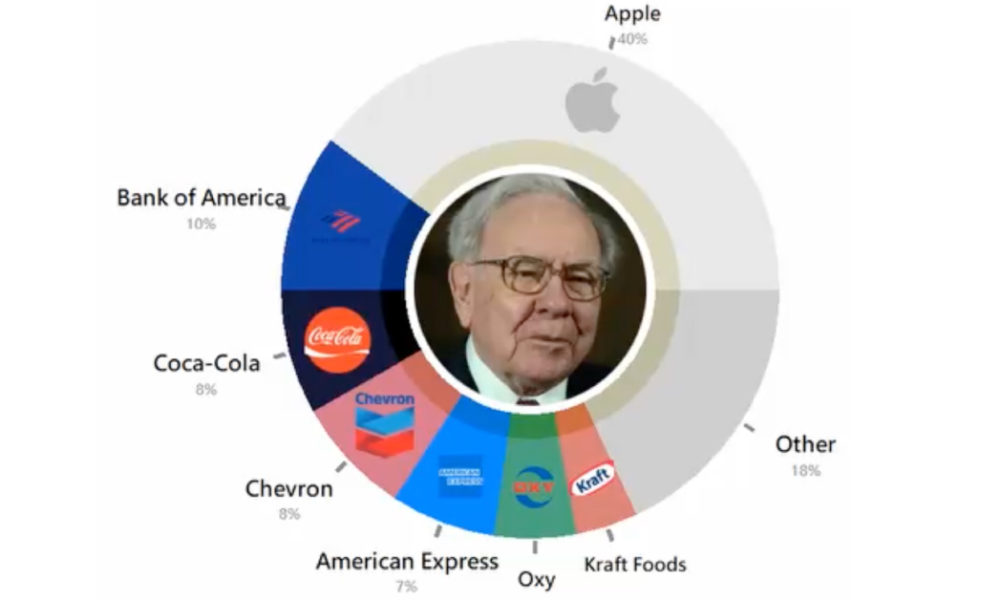

Buffett Locking in Gains

Buffett clarified that this does not reflect a change in view towards Apple’s business or investment attractiveness. Berkshire considers various factors, including tax implications and manager responsibility, when deciding on stock investments. Buffett emphasized that they do not attempt to predict markets or pick stocks based on trends but view them as businesses to serve…

-

Charlie Munger

-

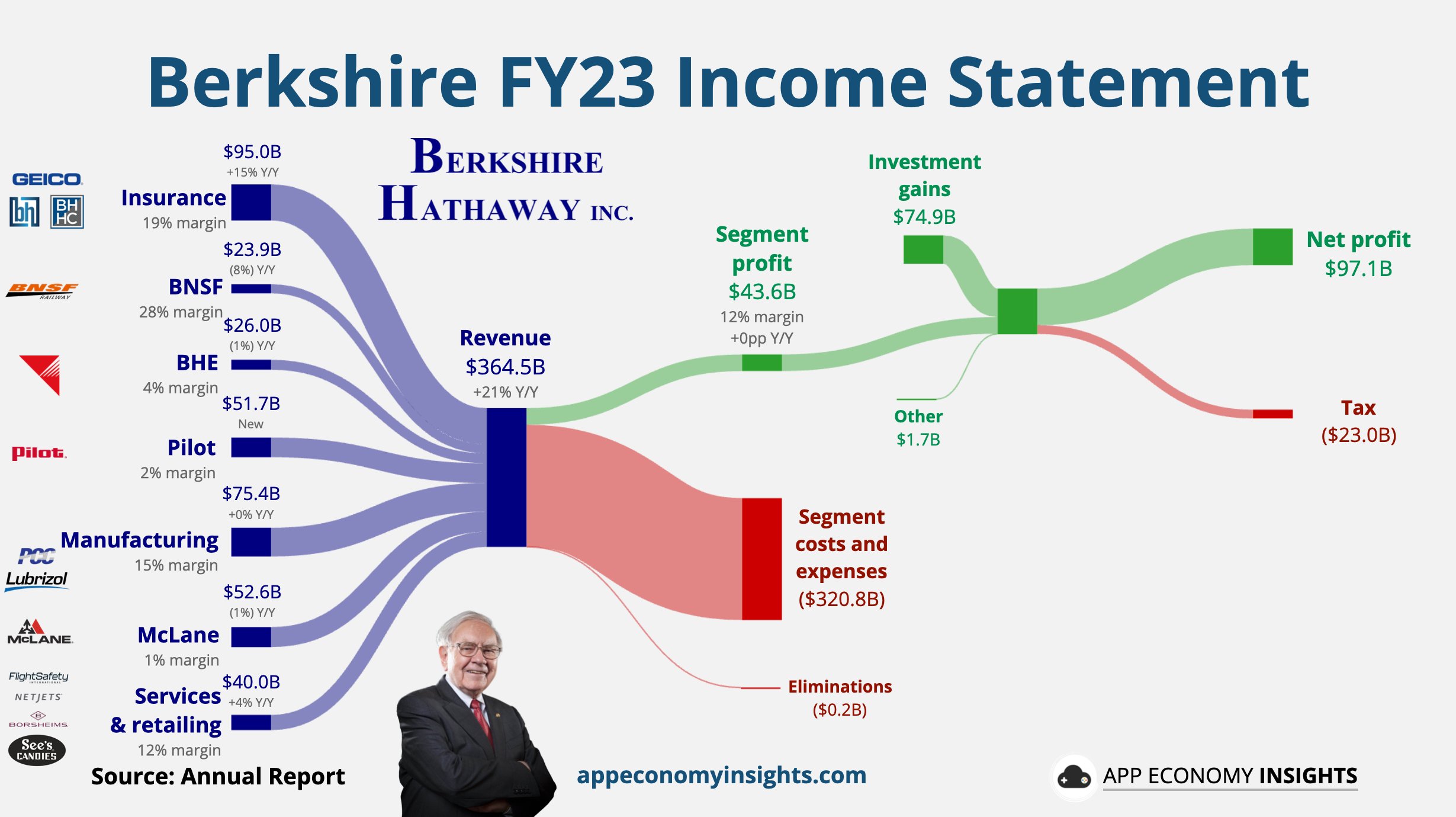

BRK Income Sources

-

Charlie Munger: The Last Interview

Charlie Munger, co-CEO of Berkshire Hathaway, reflects on his life and accomplishments in this interview. He discusses his varied interests and expertise, which have helped him succeed as a businessman and investor. Munger attributes his success to his low expectations, humility, and sense of humor, as well as surrounding himself with valuable relationships. He also talks…

-

$157B Cash Pile

Despite holding back during the pandemic, Berkshire Hathaway has started returning to the market with key transactions, such as Occidental Petroleum and Alleghany insurance. However, the cash pile has been showing up in short-term or short-dated securities, and the company has also continued to put more money into buybacks, resulting in a large share repurchase…