Category: Commercial Real Estate

-

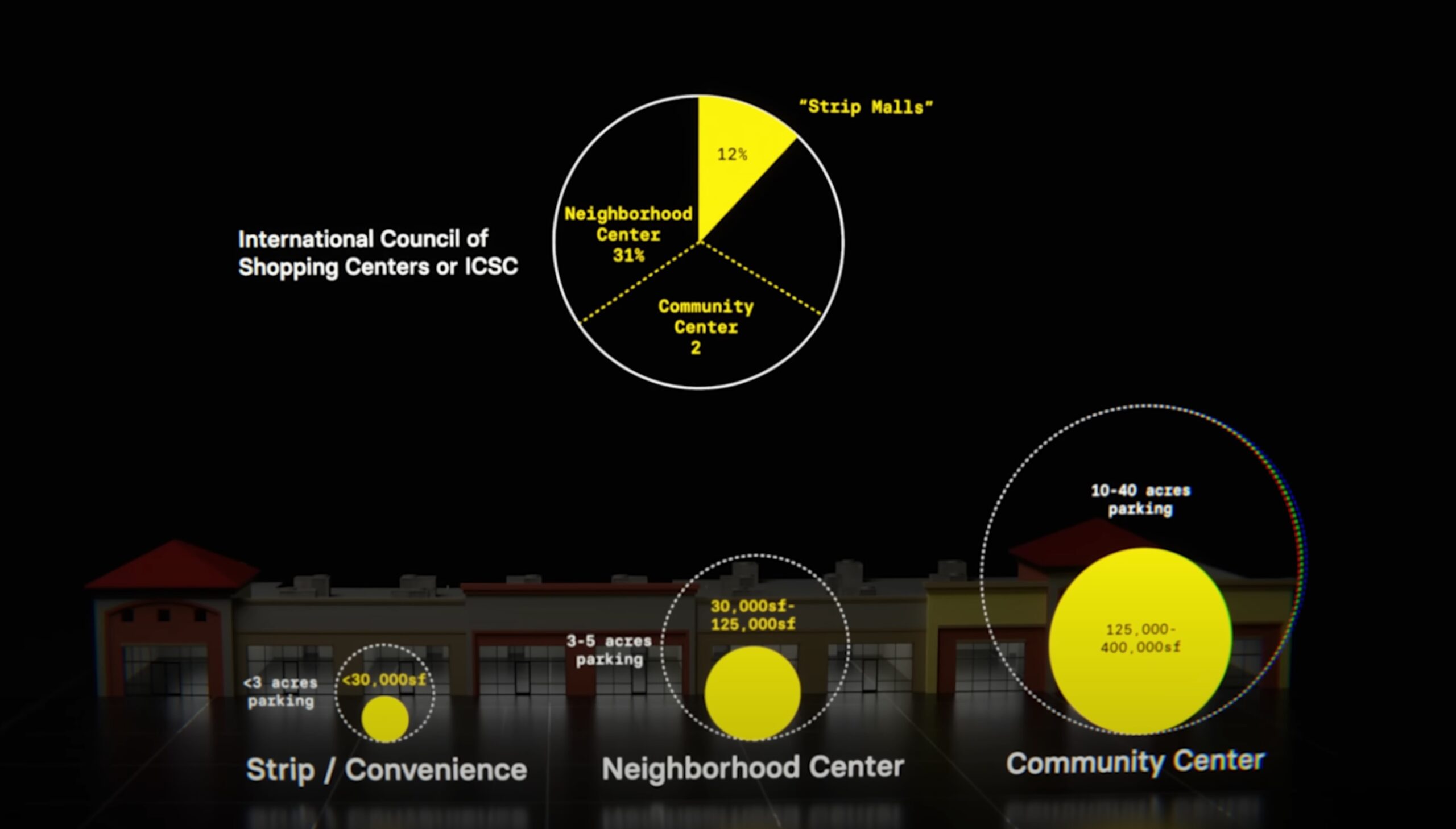

Strip Malls in America

Prof. Stewart Hicks highlights the underestimated value of strip malls, asserting their increasing appeal in real estate as they adapt to changing market demands and contribute to community resilience. Despite being seen as outdated, strip malls support local entrepreneurship and provide essential services, with a recent uptick in interest and investment driven by high lease…

-

With Flying Colors…

The spectacular results of the Federal Reserve’s stress tests on the eight largest banks. Every single one of the top 31 banks passed the tests despite holding more consumer credit card loans and corporate debt, with elevated delinquency rates and retail giants reporting that consumers are tapped out. The Fed also performed an exploratory analysis…

-

Manufacturing Slowdown?

A notably conservative panel Kevin O’Leary, Kevin Hassett, and John Carney discuss inflation, bank failures and credit card delinquencies. They attribute seasonal issues and the possibility of trend reversal to these issues, but note ongoing struggles like a capex slowdown and small business borrowing challenges. They also discuss rising credit card and automobile loan delinquencies…

-

Real Estate Trainwreck?

Chris Whalen’s YouTube video titled “Commercial Real Estate ‘Trainwreck’ Will Hit Banking System In 2024,” the banking expert discusses the challenges facing the banking industry due to commercial real estate loans. Whalen predicts that losses from commercial real estate workouts could impact bank earnings significantly. He compares the current situation to the oil patch crisis in…

-

Bank Failure: Worst since 2008

“The worst year for banks since 2008 | FT Film” discusses the tumultuous year experienced by the global banking sector in 2023, which was deemed the worst year for banks since the 2008 financial crisis. The video explores various events such as the collapse of Silicon Valley Bank (SVB) due to the decline in funding for tech…

-

Gundlach’s 2024 Predictions

Jeffrey Gundlach discusses the most surprising things he observed in 2023. He was surprised by the continuation of the market’s momentum in consumer spending despite the high interest rates on credit cards. He also commented on the surprising drop in the commodity price complex, including the issue with the Mid-East oil and the slowing global…

-

Ben Mallah

-

We(Fail)

This video describes WeWork, an office space rental company masquerading as a tech company creating a “physical social network.” Despite raising $22 billion in venture capital, WeWork never turned a profit and is considered the worst venture capital deal in history. The video discusses the significant decline of WeWork’s stock since going public, as well…

-

Bank of America Losses

131.6 Billion. Ouch