Category: CPI

-

CPI and PPI Market Reactions

Some excellent analysis by Russell Rhoads https://russellrhoads.substack.com/p/cpi-ppi-plus-big-box-retail-earnings

-

Prices Are Still Too High

According to WSJ, many Americans continue to fixate on inflation, despite the fact that prices are rising more slowly. This discontent with inflation is weighing on President Biden’s approval ratings and his re-election hopes. Although inflation has fallen, it remains a significant concern for consumers. They are particularly sensitive to rising prices because they remember…

-

Peace, Love, And Understanding…not

Jeffrey Gundlach discusses the theme of peace, love, and understanding, relating it to the current social atmosphere. He mentions the lyrics of a song by Nick Lowe, covered by Elvis Costello, that he feels captures the mood of society today. Gundlach discusses the potential for a recession based on the inverted yield curve. He explains…

-

A Serious Message From Buffett

Warren Buffett’s recent decisions to sell stocks (33B in last 3 quarters) and increase cash reserves ( to$147B), combined with Michael Burry’s options bet against the market, suggest concerns about a possible recession in the US economy. Factors such as persistent inflation, high gas prices, global instability, the AI boom, troubles in commercial real estate,…

-

Buyer Beware (pt 2)

-

Buyer Beware!

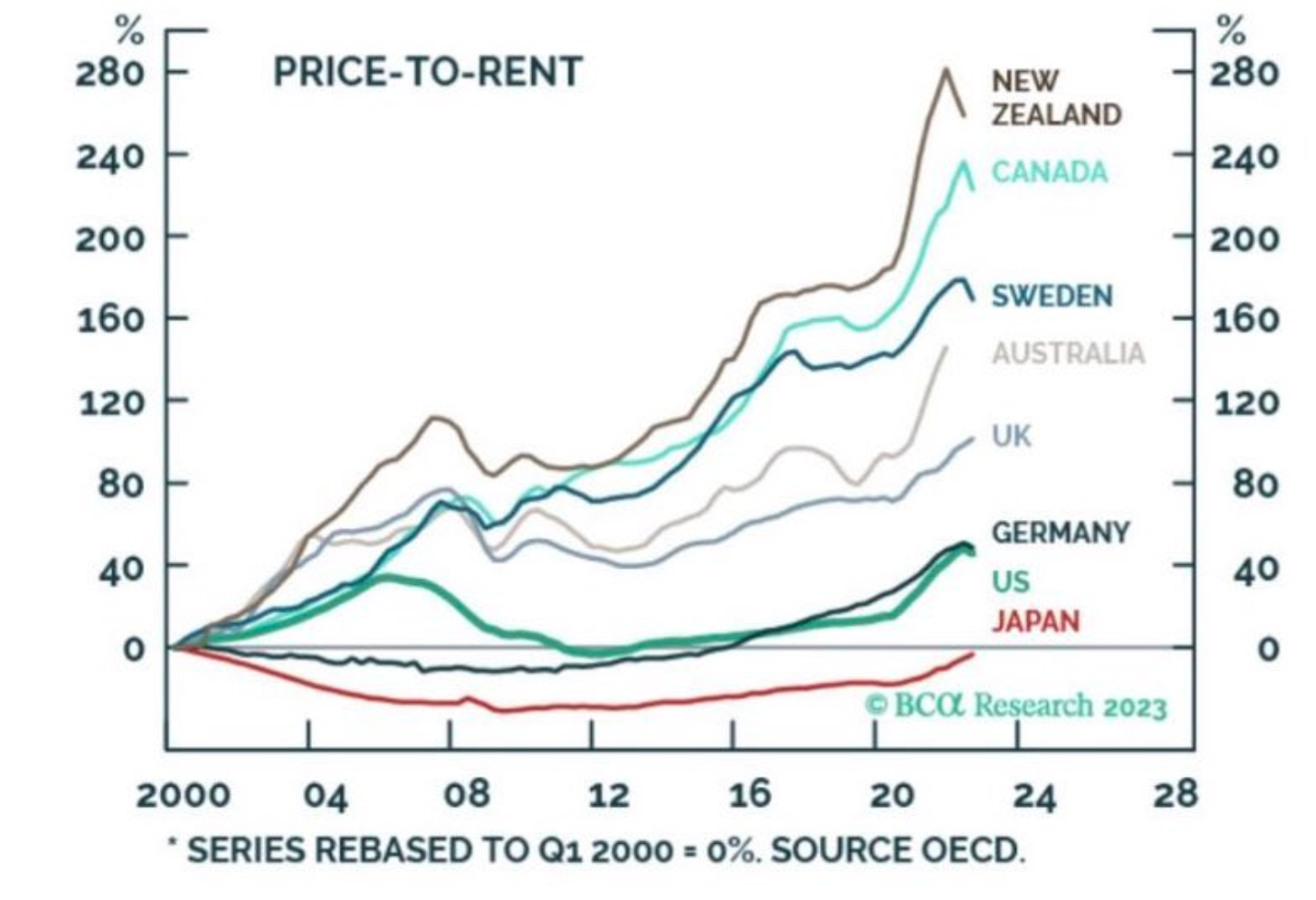

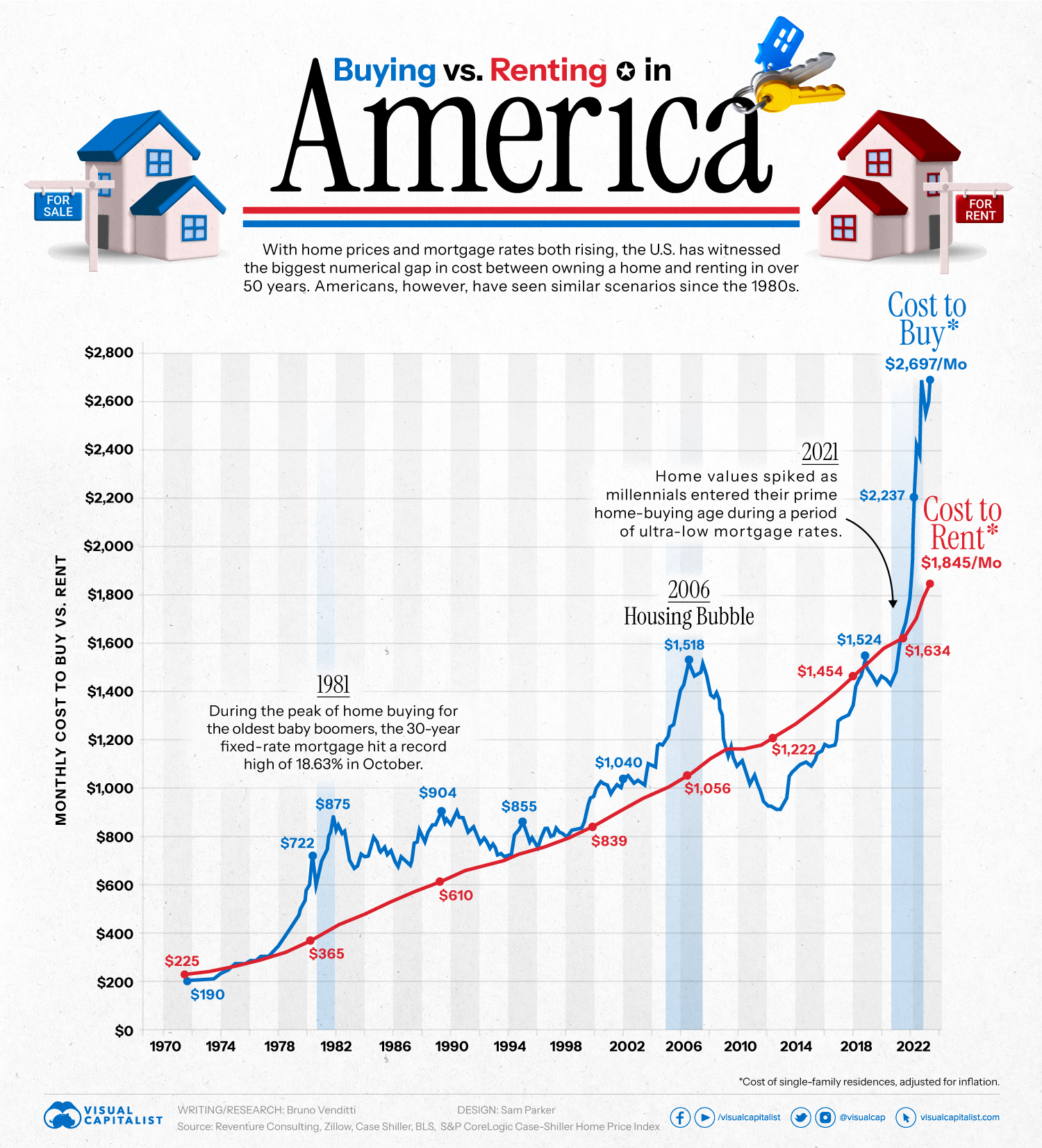

In August 2023, mortgage rates rose to the highest level in 23 years, with the national average 30-year fixed mortgage hitting 7.48%. With home prices and mortgage rates both rising, the U.S. is now witnessing the biggest numerical gap in the monthly cost between owning a home and renting in over 50 years. Today’s chart…

-

Kyle Bass

Kyle Bass, founder of Hayman Capital and one of the few to benefit from the 2008 mortgage crisis, warns of the concerning military capabilities of China and argues that American investors played a role in building their war machine. He points out that China now has more naval ships than the U.S. Navy and believes…

-

2 Broke Everyone

*when you control the printing press (and there is sufficient demand)…you can do anything you want*

-

Fed Day

https://finance.yahoo.com/news/fed-expected-to-skip-a-june-rate-hike-but-signal-more-in-the-future-141346398.html The Fed’s benchmark interest rate stands in a range of 5%-5.25%, the highest level since September 2007. As part of its most aggressive rate hiking campaign since the 1980s, the Fed has increased the target range for its benchmark interest rate by 5 percentage points since March 2022.

-

Gundlach on Macro