Category: Currencies

-

The Pro Argument

Money & Macro suggests that Trump is demanding a new global order that categorizes countries based on their economic relationship with the U.S. The narrative also highlights Trump’s focus on reindustrializing America to counter the perceived threat of deindustrialization and to strengthen the country’s position against competitors like China. The Bretton Woods system, which linked…

-

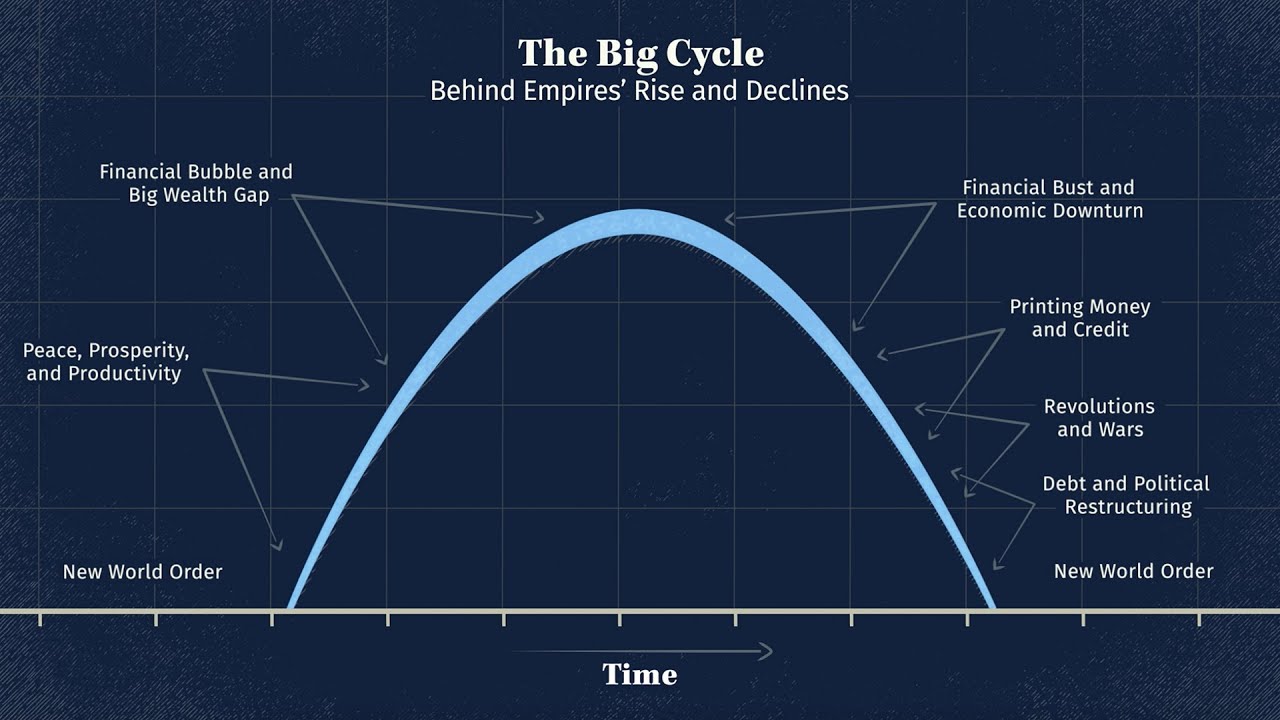

Hope

Ray Dalio and David Friedberg hope bringing attention to the US debt problem will help the government gather the courage to cut spending. Ray highlights the historical context of debt cycles and the importance of understanding patterns in financial trends to avoid severe economic crises, underlining that many currencies have faced devaluation over time. Dalio…

-

Anatomy of a Bear

“National Capitalism & Death of the International Monetary System” presents an opinion on China and its impact on global investment strategies. The dialogue covers the historical trajectory of the international monetary system since the Bretton Woods era, underscoring China’s role in maintaining low inflation and influencing U.S. monetary policies through its currency interventions. The conversation highlights…

-

In Good Company

Stan Druckenmiller discussing various aspects of the financial markets, focusing on inflation, the Federal Reserve ‘s strategies, investment decisions, trading experiences, and advice for aspiring individuals in the industry. Druckenmiller expresses concerns about potential risks from premature declarations of victory over inflation and discusses the implications of his personal investment strategies, including the importance of being forward-looking…

-

Explainer…

The Nikkei index experienced its second biggest decline in history, and the unwinding of carry trades and the Bank of Japan’s ultra-easy monetary policy were identified as primary reasons for the selloff. Buffett’s Berkshire Hathaway recently increased its cash holdings and sold a significant portion of Apple stock, leading to concerns about his bearish outlook…

-

BTC as Money?

Michael Saylor makes the case that Bitcoin should not be considered a currency due to its lack of legal tender status. He explains that using Bitcoin as a currency would result in added costs and complex accounting transactions due to its taxable status. Saylor also highlights that currencies are regulated by nation-states, and the advantages…

-

The End of the Dollar….

-

This is why the world has gone crazy….

This video explains opinions of the effects of monetary policies in Japan, China, and Hong Kong. It explains the role of quantitative easing (QE) in Japan and its effectiveness, as well as the impact of the European sovereign crisis on the Chinese economy. The importance of capital influx and trade deficits in funding industrialization is…

-

The Most Famous Trade Ever

-

BTC “Staying Power”

The inaugural Coinbase State of Crypto Summit was focused on regulation and the macro landscape, with institutional investors, corporations, policymakers, and academics in attendance. The sentiment in the industry has been high since BlackRock filed for a spot Bitcoin ETF, signaling that it sees a place for Bitcoin in an investment portfolio. Additionally, Fed chair…