Category: DEBT

-

“Never Short a Cult”

Steve on bubbles, risk, and revenue “projections”.

-

“The norm is not the average”

S&P 500 PE ratio above 23 historically resulted in 2-2% annualized returns over 10 years, with current PE ratio at 24, indicating low expected returns for the next decade.Oaktree Capital has consistently invested in high-yield bonds for 47 years, achieving 7-8% yields comparable to 10% S&P 500 returns, but taxes reduce after-tax returns to 4-7%.…

-

Borrow to Pay

An explanation of how debt fueled spending makes world turn and what happens when lenders stop lending.

-

Lost Confidence

DoubleLine Group CEO Jeffrey Gundlach talks about the price of gold, fixed income, private credit, President Donald Trump’s tax bill, Federal Reserve monetary policy and artificial intelligence with Lisa Abramowicz at the Bloomberg Global Credit Forum in Los Angeles.

-

La Disgrazia

Budget deficits of appx 8% of GDP a year are a problem for Friedberg. He suggests pausing all new spending and reducing all spending to pre covid levels.

-

In Bessent’s Words…

Bottom line: rate cuts, banking deregulations, or any kind of stimulus package are not coming anytime soon Bessent’s interview with Tucker Carlson reaffirmed a lot of views that many of us already held—but I think it’s worth highlighting a few key points that are particularly relevant. First, they’re 100% serious about addressing the wealth imbalance.…

-

The Man Behind the Curtain

Howard Lutnick, close friend of Donald Trump, current Secretary of Commerce, and former CEO of Cantor Fitzgerald discusses strategic initiatives aimed at budget management, emphasizing the potential for significant federal spending cuts and improvements in efficiency, such as leveraging existing resources and addressing government fraud. Through anecdotes involving high-profile figures like Elon Musk, Lutnick presents…

-

Debt Disaster

How Verizon purchased brands with debt and tried to compete with Facebook and Google in the digital advertising and data business.

-

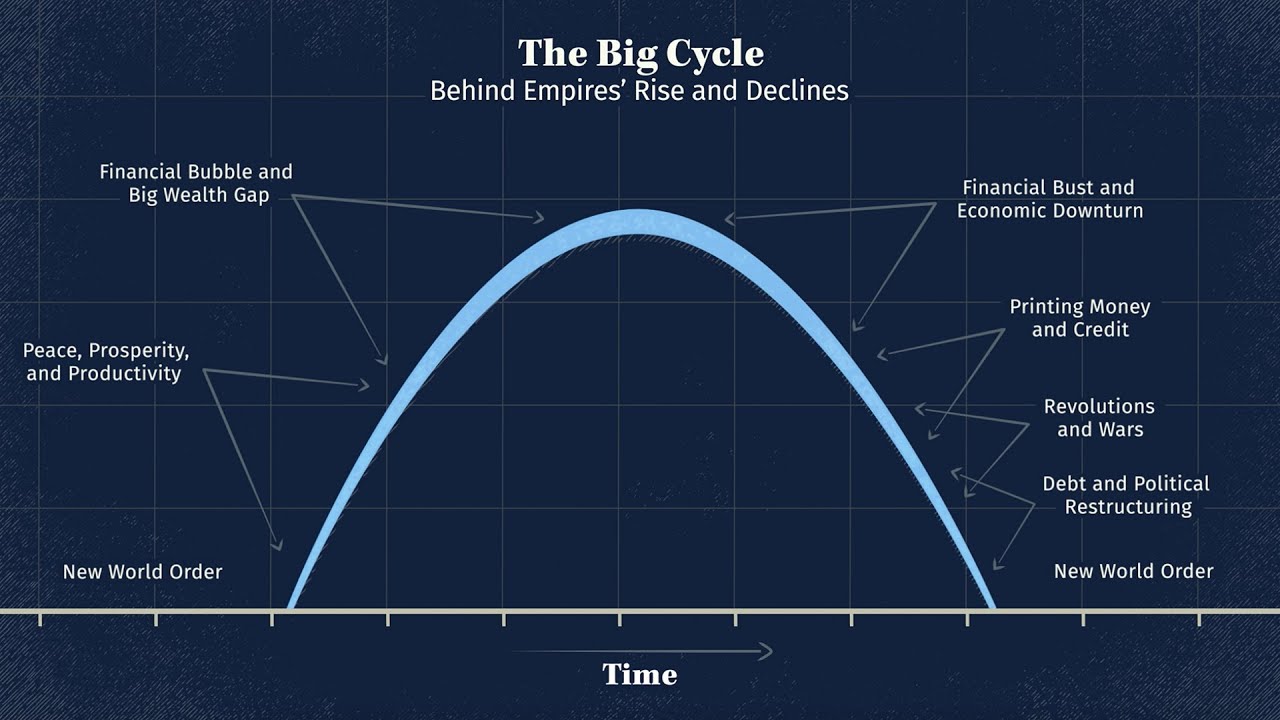

Hope

Ray Dalio and David Friedberg hope bringing attention to the US debt problem will help the government gather the courage to cut spending. Ray highlights the historical context of debt cycles and the importance of understanding patterns in financial trends to avoid severe economic crises, underlining that many currencies have faced devaluation over time. Dalio…