Category: Economics Explained

-

College Sports and Contracts

“How Money Has Permanently Changed College Basketball” delves into the profound effects of Name, Image, and Likeness (NIL) on the sport, noting a shift in recruitment practices as teams leverage collective funds to financially incentivize players, leading to concerns about competition dynamics and the integrity of the game. Coaches are retiring due to the increasing pressures from…

-

Econ in 20 minutes

tl;dr: great video on theories why humans make “bad” choices over and over again.

-

What Causes Recessions

The four major theories of business cycles in relation to the Great Recession of 2008: Keynesian theory, real business-cycle theory, monetarist approaches, and the Austrian School of Economics. Each theory offers a unique perspective on the causes of the recession. Keynesian economics attributes the recession to a shortfall in aggregate demand, while real business-cycle theorists…

-

The Pro Argument

Money & Macro suggests that Trump is demanding a new global order that categorizes countries based on their economic relationship with the U.S. The narrative also highlights Trump’s focus on reindustrializing America to counter the perceived threat of deindustrialization and to strengthen the country’s position against competitors like China. The Bretton Woods system, which linked…

-

Trump, Tariffs, and Tesla

Professor Damodaran discusses the intricate relationship between politics and investing in the context of globalization , job losses, and economic disruption. Noting the significant impact of globalization since the 1980s, particularly highlighting China’s dramatic growth and the resultant winners and losers, including blue-collar workers and small businesses affected by these shifts. The discussion touches on the political…

-

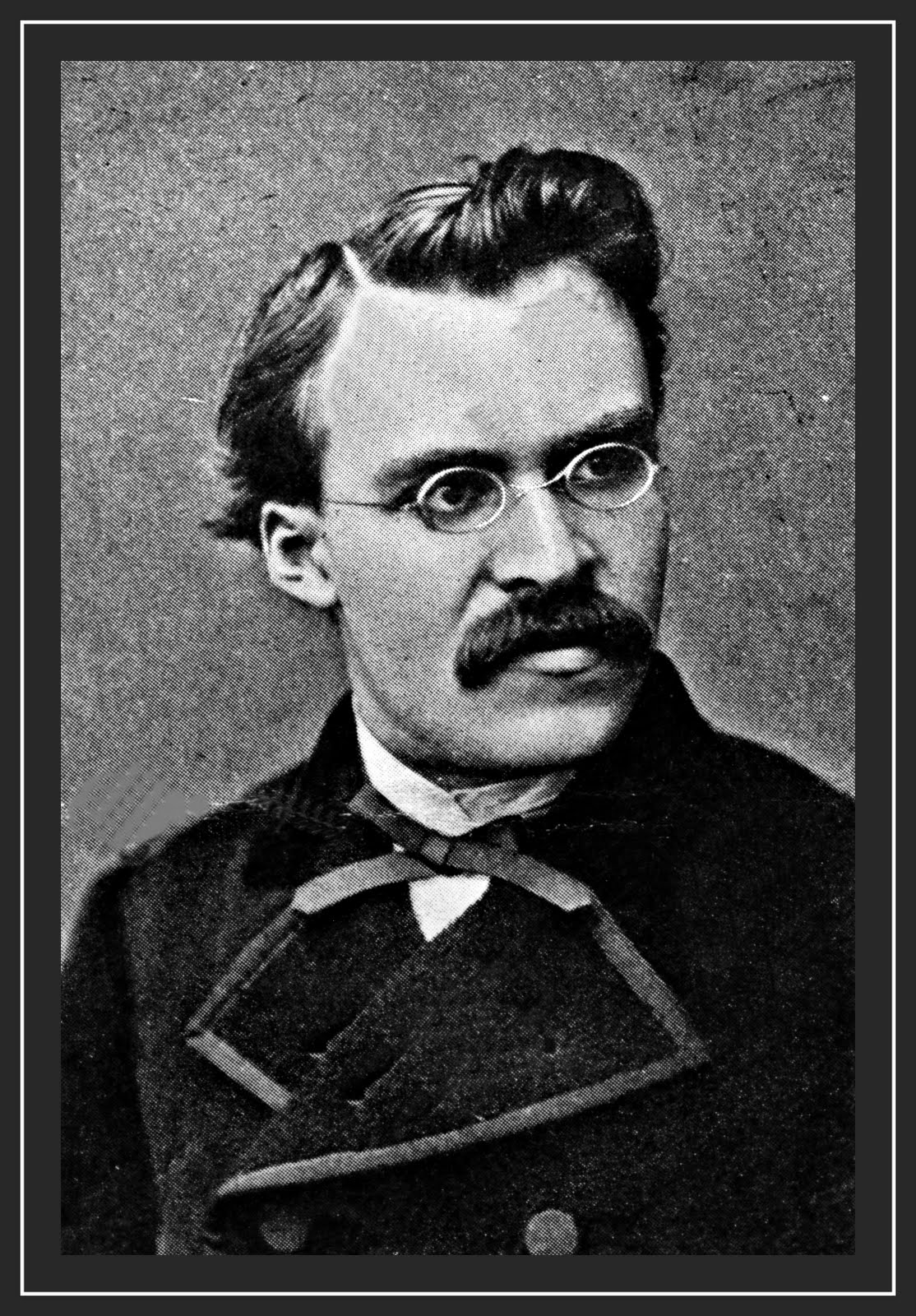

Nietzsche on Power

Possibly more predictive and instructive than all modern economic texts. Definitely a frame for understanding personalities like Putin, Xi, and Trump, Nietzsche and the Truth About Power” investigates the dynamics of power and morality by contrasting individuals who succeed through integrity with those who manipulate and exploit others. It draws on Nietzsche’s philosophy , particularly the concepts…

-

Why Are We Importing Oil?

“Why Does The US Import Oil When They Produce So Much?” explores the paradox of the U.S. being the world’s largest oil producer while still being the second-largest importer of oil, despite significant growth fueled by hydraulic fracking and technological advancements since 2008. It reflects on historical oil dependency, especially during the 1970s crises, which catalyzed a…

-

How Google Makes Money

Aravind Srinivas and Lex Fridman, they explain that Google earns revenue primarily through search advertising on Google AdWords. Google’s search engine, with its high daily traffic, serves as the largest real estate on the internet for advertisers to bid for keywords related to their businesses. When users click on these ads, Google charges the advertisers, with…

-

Fed Cuts?

-

Dark Pools vs Lit Trading

Dark pools, around since the 90s, are legal and regulated, but trades are kept hidden until after execution. They have grown in popularity, capturing 40% of US market share in 2021, and are used by hedge funds, pension funds, mutual funds, and brokers. Dark pools offer anonymity and potential additional liquidity, but lack of transparency…