Category: Economy

-

Kyle Bass

Kyle Bass, founder of Hayman Capital and one of the few to benefit from the 2008 mortgage crisis, warns of the concerning military capabilities of China and argues that American investors played a role in building their war machine. He points out that China now has more naval ships than the U.S. Navy and believes…

-

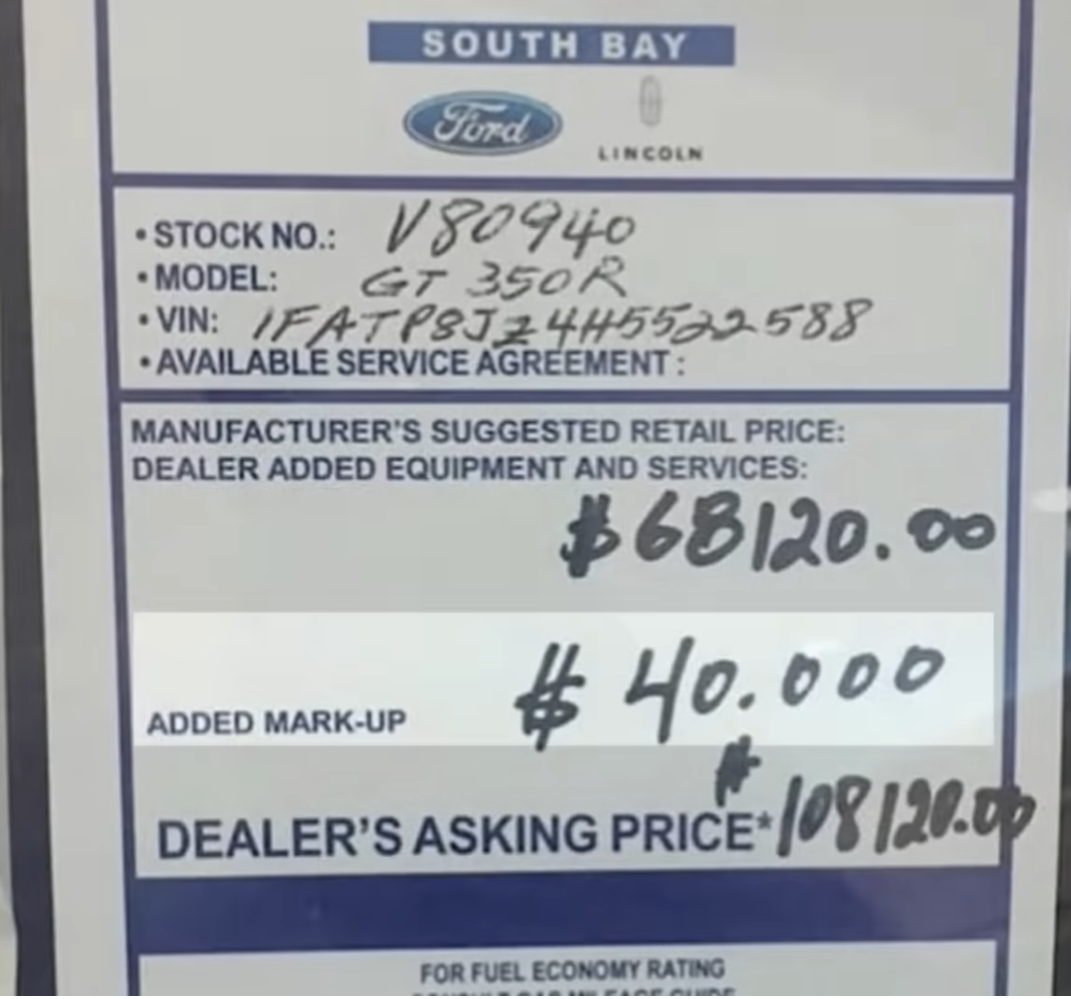

Car inflation….

One factor is the high demand for affordable transportation, which led to older cars becoming valuable commodities instead of being scrapped. As a result, there are fewer average cars available for the middle class. The high-price, high-margin models received first priority and pick of the limited semiconductors supply sourced from China. Car manufacturers and dealers…

-

Oaktree’s new CEO

Armen Panossian (Co-CEO of 160B fund Oaktree Capital, now a subsidiary of Brookfield) discusses his new role, transaction volume, and partnerships in the private lending universe, particularly in real estate and corporate lending. He mentions liquidity in the market is significantly lower, with less trading volume and new issuance in high-yield bonds and senior loans.…

-

Griffin at Goldman

-

2 Broke Everyone

*when you control the printing press (and there is sufficient demand)…you can do anything you want*

-

Commercial Real Estate

1.4 trillion of commercial debt is coming due in the US alone, and with the cost of borrowing being up and the value of buildings down, refinancing may not be possible for some. Many banks, lenders, and owners have to decide what to do as it is unclear how much further down it will go.…

-

Econ 101?

Senator Kennedy questions Federal Reserve Chairman Jerome Powell about inflation and capital requirements for banks. **Powell explains that we had very little inflation for 25 years** and that inflation depends on whether tax increases or spending cuts are part of a congressional budget plan. If there were no spending cuts, he believes there would be…

-

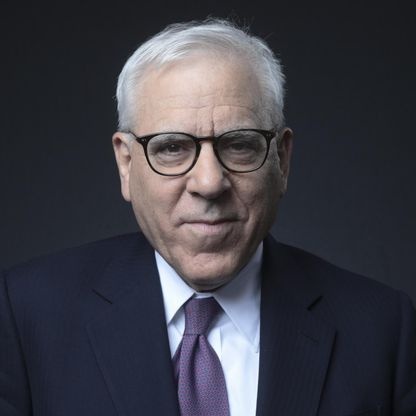

Rubenstein on Real Estate

David Rubenstein, co-founder and co-chairman of Carlyle Group, believes that the biggest investment opportunity over the next 2 to 3 years lies in the discounted real estate debt market, specifically in large commercial office buildings in major cities. Rubenstein acknowledges the challenges facing some cities, such as public relations issues and declining real estate prices,…

-

6/21/23

https://finance.yahoo.com/news/powell-nearly-all-fed-members-expect-to-raise-rates-again-this-year-123006616.html Advanced economies like the US have had a head start on developing advanced industries, making it difficult for others to catch up. Europe, despite being primarily comprised of already advanced economies, lacks the innovative global companies compared to the US and even the new players coming from Asia, with exceptions like Germany and France,…