Category: Education

-

Li Lu

Li Lu and Charlie Munger and Warren Buffett,” the speaker shares experiences and insights from meetings and mentorships with Charlie Munger and Warren Buffett. Munger, initially perceived as distant, provided valuable advice and encouraged long-term investment strategies. Buffett admired Munger’s ability to understand complex businesses and expand his investment horizons. Li Lu, a Chinese businessman,…

-

Probability

Howard Marks explores the concept of risk through four key points. First, he highlights that the future is uncertain, and more outcomes are possible than will occur. Second, knowing probabilities does not eliminate uncertainty, as even the most probable outcomes are not guaranteed. Third, using the analogy of rolling dice, Marks illustrates that while we…

-

Meditations on Extremistan

In “Meditations on Extremistan,” Nassim Taleb discusses the concept of extreme events and their impact on various phenomena, using examples from finance, human height, and behavioral economics. Taleb emphasizes that while extreme deviations cannot be completely ruled out, they are unlikely in certain phenomena without compelling explanations based on physical processes or energy. He criticizes…

-

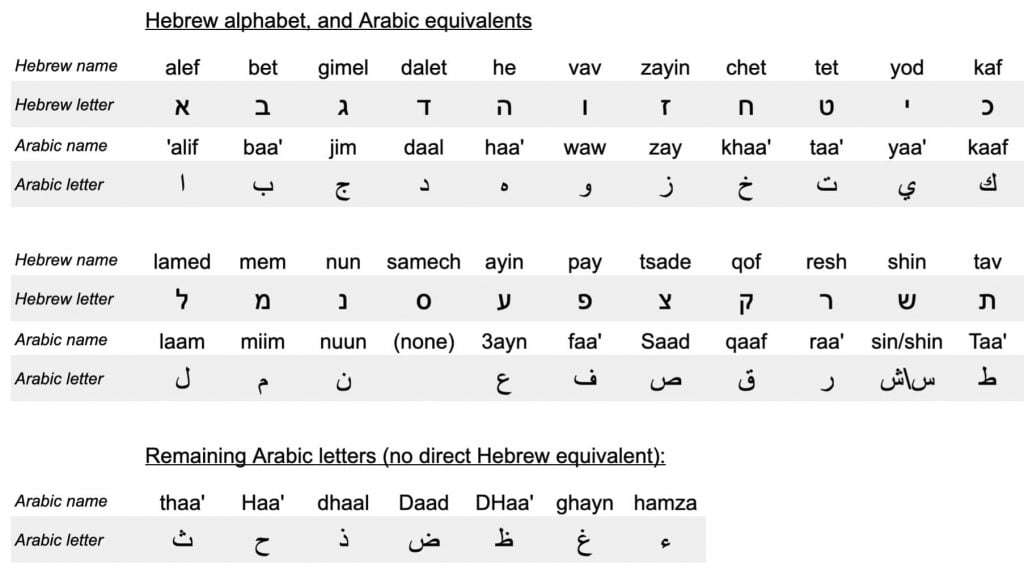

Peace in the Middle East?

Rabbi Simon Jacobson interviews Loay Alshareef who shares his personal journey from holding hateful views towards Jews and Americans to promoting interfaith dialogue and understanding. Alshareef discusses his upbringing in Saudi Arabia and the influence of religious texts and figures on his beliefs, emphasizing the importance of debunking misinformation and promoting knowledge and understanding. He also reflects…

-

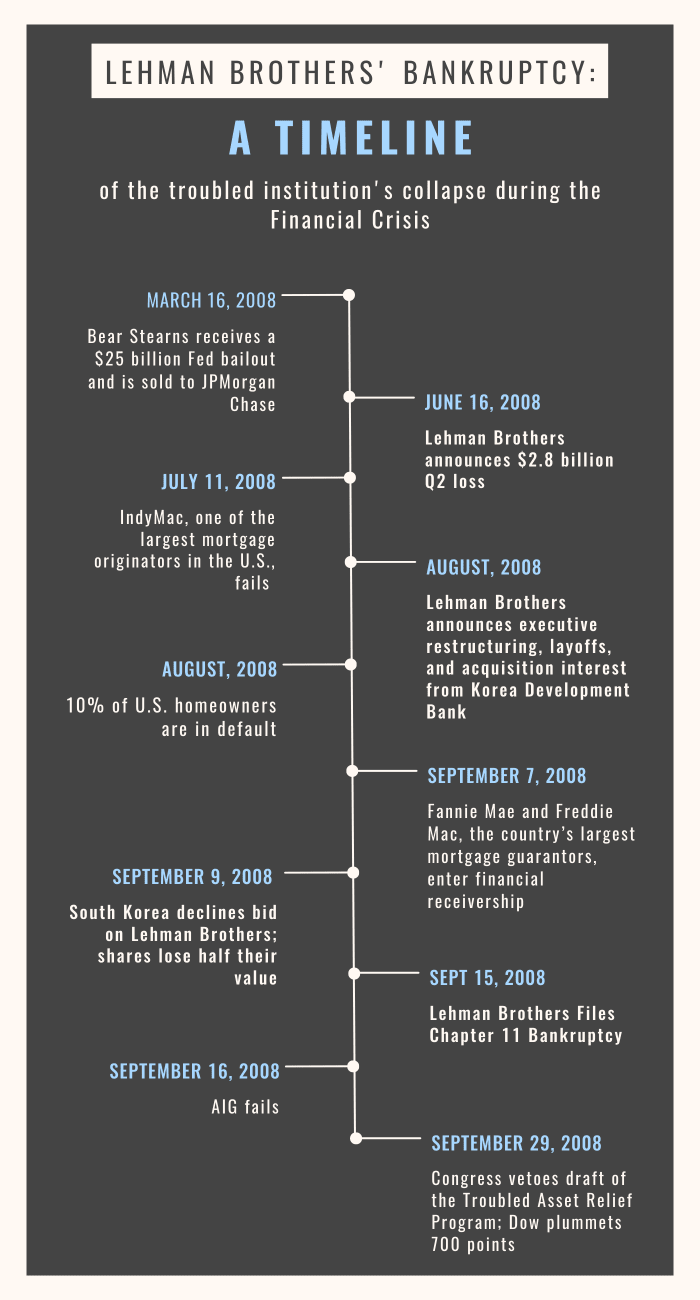

Lehman Bros

Wall Street during the early 2000s, with a focus on Lehman Brothers, one of the oldest and most aggressive investment banks. The mortgage industry saw significant growth due to securitization and government encouragement of homeownership, leading to the bundling and selling of mortgage contracts to institutional buyers worldwide. Lehman’s executives, such as Anthony Fry and…

-

Why 2% Succeed. Lessons from Warren Buffett

Buffett expresses his belief in investing only in things he understands and shares his experience with evaluating businesses based on their economic characteristics. He uses examples of industries like automobiles and airplanes to illustrate how difficult it is to predict winners and emphasizes the importance of understanding the economic consequences of a business. Buffett shares…

-

Explainer…

The Nikkei index experienced its second biggest decline in history, and the unwinding of carry trades and the Bank of Japan’s ultra-easy monetary policy were identified as primary reasons for the selloff. Buffett’s Berkshire Hathaway recently increased its cash holdings and sold a significant portion of Apple stock, leading to concerns about his bearish outlook…

-

The Flat Earth Trading Society

In this Flat Earth Trading Society video, Robb Reinhold discusses the challenges of setting stops for trades based on dollar amounts or percentages due to different stocks’ volatility. The “Flat Earth Trading Society” videos are a joke/demo by Robb to not only promote his prop trading firm, but also demonstrate how to let winners run…

-

Memeconomy

“The Peak Of Crypto Degeneracy,” discusses the surge in interest and value of Solana and meme coins. Solana, founded in 2020, is a California-based for-profit company that uses a proof of stake consensus mechanism and supports smart contracts. Its main selling point is faster and more efficient transactions than its main competitor, Ethereum. The creation…

-

Schwager

Jack Schwager reflects on the impact of his interviews with successful traders, particularly those featured in his Market Wizard series. Schwager shares that some of the best traders he’s ever met were part of this project including Michael Marcus, Bruce Kovner, Stan Druckenmiller, and one trader who turned $5,000 into $50 million and later $250…