Category: Efficient market hypothesis

-

Mike Green on “Passive”

The causes, risks, and future related to passive investing and its influence on the markets. In summary Mike has quantified 1) the effects of regulatory and QDIA changes as well as 2) value managers being fired and passive managers being hired. https://www.simplify.us/leadership

-

Never Say Never

Cliff Asness, founder of AQR Capital Management, discusses his views on market efficiency. Asness recalls his experience in Eugene Fama’s efficient market theory class, where he learned that markets are not perfectly efficient, causing a gasp among students. He explains that while markets are more efficient than he believes, perfect efficiency is an unrealistic concept.…

-

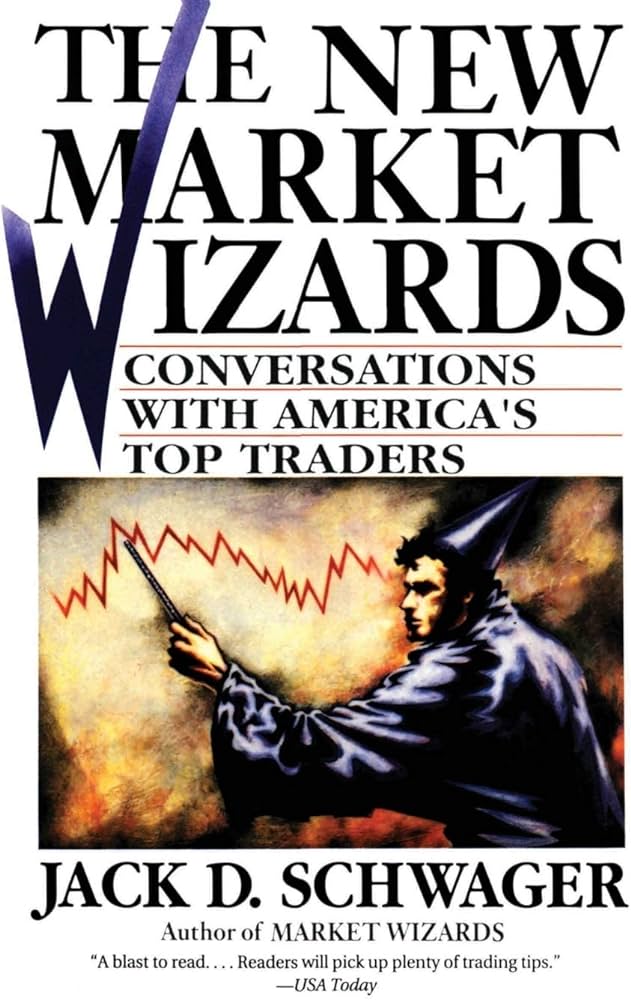

Lessons From the Best

Jack Schwager, author of “Market Wizards,” discusses his advice for aspiring traders in a series of YouTube interviews. He emphasizes the importance of risk management, setting stop losses, and being objective when making decisions to exit a trade. He also discusses Bruce Kovner, Michael Marcus, compares fundamental and technical trading, and indexes like the Magnificent…

-

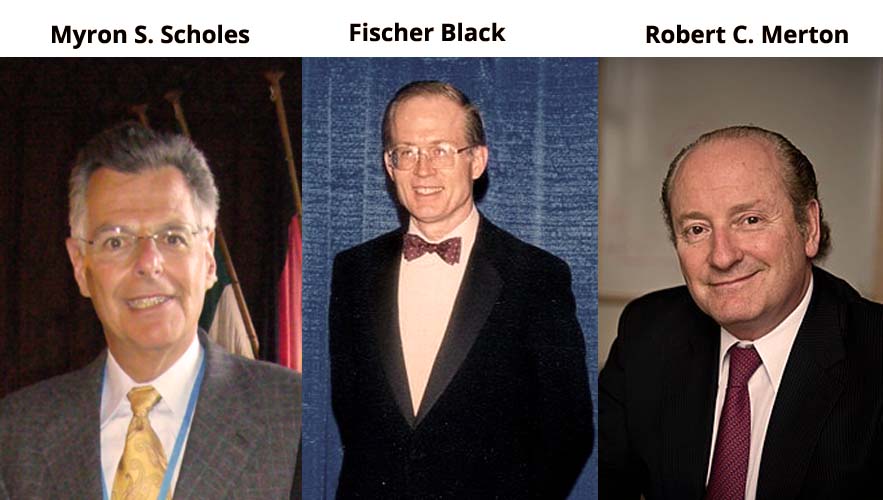

Trillion Dollar Assumptions

“The Trillion Dollar Equation,” video from Veritasium explores the model that spawned multi-trillion dollar industries. More specifically how Bachelier applied Fourier, how Ed Thorp made money applying the model, and finally how Black, Scholes and Merton published the model. Some immediate.trade content and expected ranges come from Black Scholes, but the rest of the content…