Category: Federal Reserve

-

7 to 108 Billion

Howard Marks discusses the upcoming sea change in financial markets and the potential implications for investors. He highlights the shift from declining or ultra-low interest rates to a higher interest rate environment, stating that credit instruments may provide equity-like returns and become more attractive. Marks reflects on his career at Oaktree and the growth of…

-

Wall Street Week 9.22.23

If rates remain high, it can lead to a slower liquidation for those who are overleveraged, but stocks and the economy could still fare well in such a scenario. Government spending and borrowing could also impact the rate structure, potentially crowding out borrowers and making it difficult for rates to come down significantly. Finally, the…

-

“Well Publicized Trouble”

Kimball Brooker Jr. of First Eagle explains how uncertainty around Chinese economic growth has impacted global equity markets and why the Global Value team is maintaining a cautious outlook as the yield curve remains inverted. https://www.firsteagle.com/insights/september-views-first-eagle-global-value-team-0 https://www.dataroma.com/m/holdings.php?m=FE

-

Tom Lee Says Buy in a Risk Off Environment

Tom Lee shares some insights on the potential impact of the Federal Reserve’s decision to stop raising rates. While some believe this could lead to further stock market decline, Lee suggests it may trigger a risk rally and actually cause a stock market rally. He emphasizes that the Fed’s decision does not necessarily mean they…

-

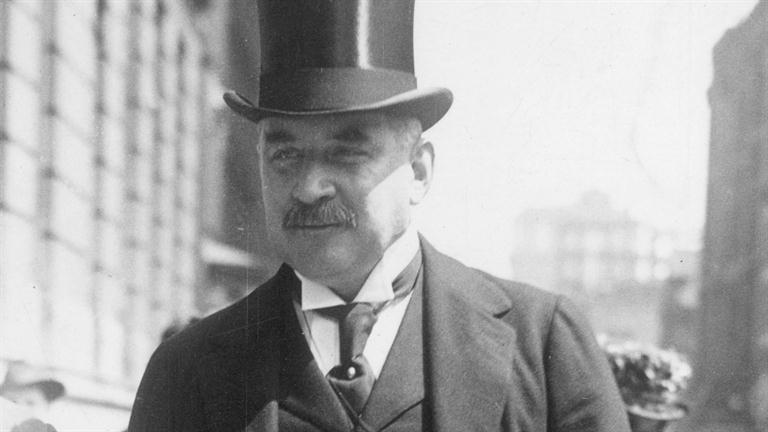

This Man Saved the U.S. From Ruin

-

Giving Themselves a Pat on the Back…

Cleveland Fed President Loretta Mester acknowledges that there has been stronger growth than expected, along with lower inflation and higher long-term rates, which could put downward pressure on inflation. She believes that under-tightening would be a worse mistake than over-tightening and emphasizes the importance of monitoring the economy and achieving a soft landing. Mester expects…

-

This is why the world has gone crazy….

This video explains opinions of the effects of monetary policies in Japan, China, and Hong Kong. It explains the role of quantitative easing (QE) in Japan and its effectiveness, as well as the impact of the European sovereign crisis on the Chinese economy. The importance of capital influx and trade deficits in funding industrialization is…

-

Public vs. Private

Ray Dalio’s thoughts on the ongoing transfer of wealth….the link below is worth looking at just for the charts The economy is not reacting to the Fed’s tightening in the usual way, as evidenced by the data in the charts. The shift in wealth from the public sector (central government and central bank) and government…

-

Should the fed declare victory?

Jeff Gundlach notes Import and Export prices, are looking encouraging. However, he also mentions that these prices are currently in negative double digits compared to previous years, indicating disinflationary pressure. Gundlach believes that the massive stimulus and economic distortions from 2020 and 2021 have led to inflation, which is still bubbling through the system. He…