Category: Federal Reserve

-

Bianco Predicts…

The Magnificent Seven stocks (FANG stocks, plus Tesla, Microsoft, and Nvidia) have contributed significantly to the overall market gains. Bianco attributes their success to the hype around artificial intelligence and the rollout of new technologies. However, he also notes that the performance of the other 493 stocks in the S&P 500 has been less impressive,…

-

Soft Landing

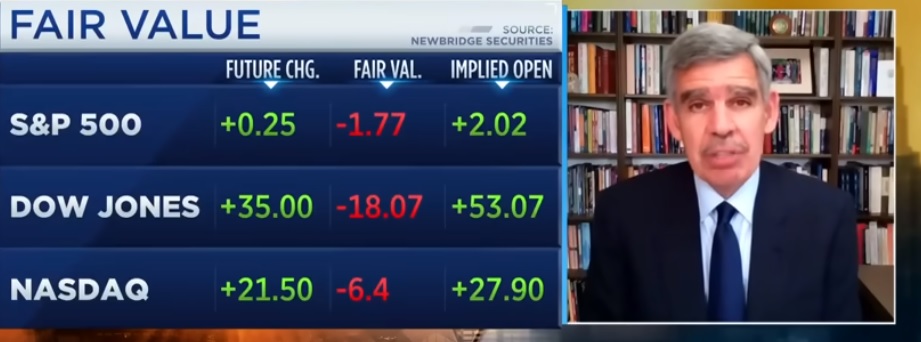

Mohamed El-Erian, former CEO and current academic and economic adviser, thinks that a soft landing narrative in the economy, combined with *money on the sidelines*, is driving the current rally. El-Erian acknowledges the bearish sentiment among investors but believes good earnings numbers could bring some back. *reminder…there is no such thing as money on the…

-

Blackstone forecasts….

Blackstone CFO Michael Chae sees inflation trending down and economic resilience. However, he also highlights the challenges of the cost of capital and the availability of capital, which are affected by factors like short rates, quantitative tightening ($1T annually), and credit contraction. As a result, Blackstone expects the Fed to deliver a slowdown to the…

-

2 Broke Everyone

*when you control the printing press (and there is sufficient demand)…you can do anything you want*

-

Econ 101?

Senator Kennedy questions Federal Reserve Chairman Jerome Powell about inflation and capital requirements for banks. **Powell explains that we had very little inflation for 25 years** and that inflation depends on whether tax increases or spending cuts are part of a congressional budget plan. If there were no spending cuts, he believes there would be…

-

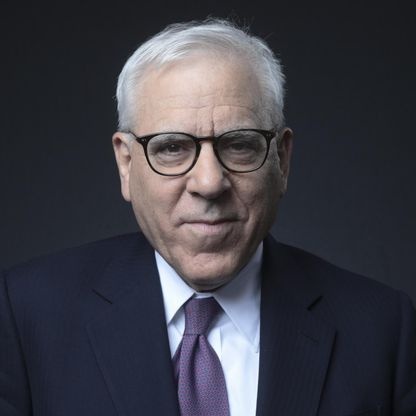

Rubenstein on Real Estate

David Rubenstein, co-founder and co-chairman of Carlyle Group, believes that the biggest investment opportunity over the next 2 to 3 years lies in the discounted real estate debt market, specifically in large commercial office buildings in major cities. Rubenstein acknowledges the challenges facing some cities, such as public relations issues and declining real estate prices,…

-

Balaji Panics….

Balaji Srinivasan discusses the recent financial crisis and compares it to the one that happened in 2008. He explains that over the course of 2021, many people were saying that inflation was going to happen, but the Federal Reserve continued to sell hundreds of billions of dollars in bonds during this period. However, in December…

-

Tom Lee on 2023

-

JUNE FOMC

https://assets.realclear.com/files/2023/06/2201_fomc.pdf June FOMC Meeting: Saying They Will If They Have To, But Hoping They Won’t Have To? › The FOMC made no change to the Fed funds rate target range, leaving the mid-point of the target range at 5.125 percent › The updated dot plot implies a terminal Fed funds rate target range mid-point of…

-

Time For Bonds

https://finance.yahoo.com/news/jpmorgan-michele-says-time-exit-143330550.html I don’t agree with this but…… it’s interesting to read what the other side thinks….. JPMorgan’s Michele Says It’s Time to Exit ‘Cash Trap’ and Move Into Bonds JPMorgan’s Michele Says It’s Time to Exit ‘Cash Trap’ and Move Into Bonds (Bloomberg) — It’s time to exit the “cash trap” of money market funds…