Category: FOMC

-

A Serious Message From Buffett

Warren Buffett’s recent decisions to sell stocks (33B in last 3 quarters) and increase cash reserves ( to$147B), combined with Michael Burry’s options bet against the market, suggest concerns about a possible recession in the US economy. Factors such as persistent inflation, high gas prices, global instability, the AI boom, troubles in commercial real estate,…

-

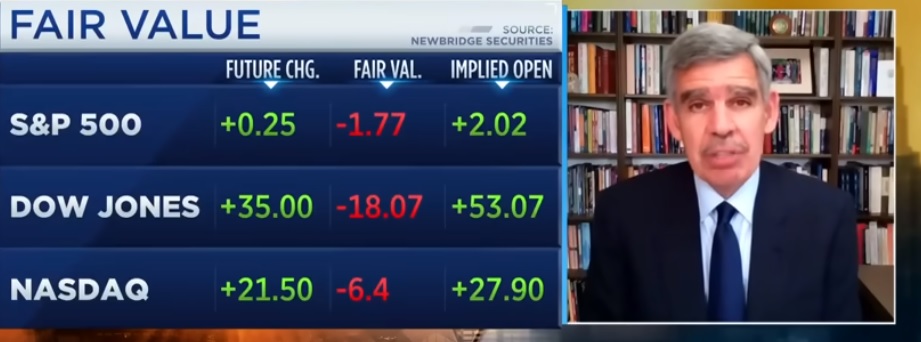

Soft Landing

Mohamed El-Erian, former CEO and current academic and economic adviser, thinks that a soft landing narrative in the economy, combined with *money on the sidelines*, is driving the current rally. El-Erian acknowledges the bearish sentiment among investors but believes good earnings numbers could bring some back. *reminder…there is no such thing as money on the…

-

Kyle Bass

Kyle Bass, founder of Hayman Capital and one of the few to benefit from the 2008 mortgage crisis, warns of the concerning military capabilities of China and argues that American investors played a role in building their war machine. He points out that China now has more naval ships than the U.S. Navy and believes…

-

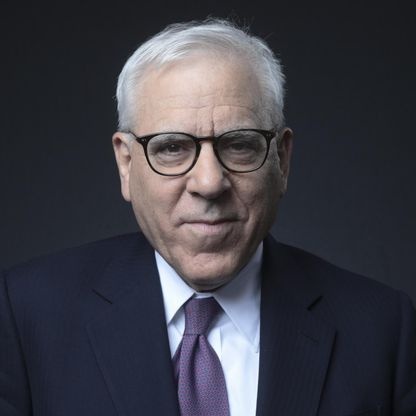

Rubenstein on Real Estate

David Rubenstein, co-founder and co-chairman of Carlyle Group, believes that the biggest investment opportunity over the next 2 to 3 years lies in the discounted real estate debt market, specifically in large commercial office buildings in major cities. Rubenstein acknowledges the challenges facing some cities, such as public relations issues and declining real estate prices,…

-

Balaji Panics….

Balaji Srinivasan discusses the recent financial crisis and compares it to the one that happened in 2008. He explains that over the course of 2021, many people were saying that inflation was going to happen, but the Federal Reserve continued to sell hundreds of billions of dollars in bonds during this period. However, in December…

-

JUNE FOMC

https://assets.realclear.com/files/2023/06/2201_fomc.pdf June FOMC Meeting: Saying They Will If They Have To, But Hoping They Won’t Have To? › The FOMC made no change to the Fed funds rate target range, leaving the mid-point of the target range at 5.125 percent › The updated dot plot implies a terminal Fed funds rate target range mid-point of…