Category: forecast

-

A Serious Message From Buffett

Warren Buffett’s recent decisions to sell stocks (33B in last 3 quarters) and increase cash reserves ( to$147B), combined with Michael Burry’s options bet against the market, suggest concerns about a possible recession in the US economy. Factors such as persistent inflation, high gas prices, global instability, the AI boom, troubles in commercial real estate,…

-

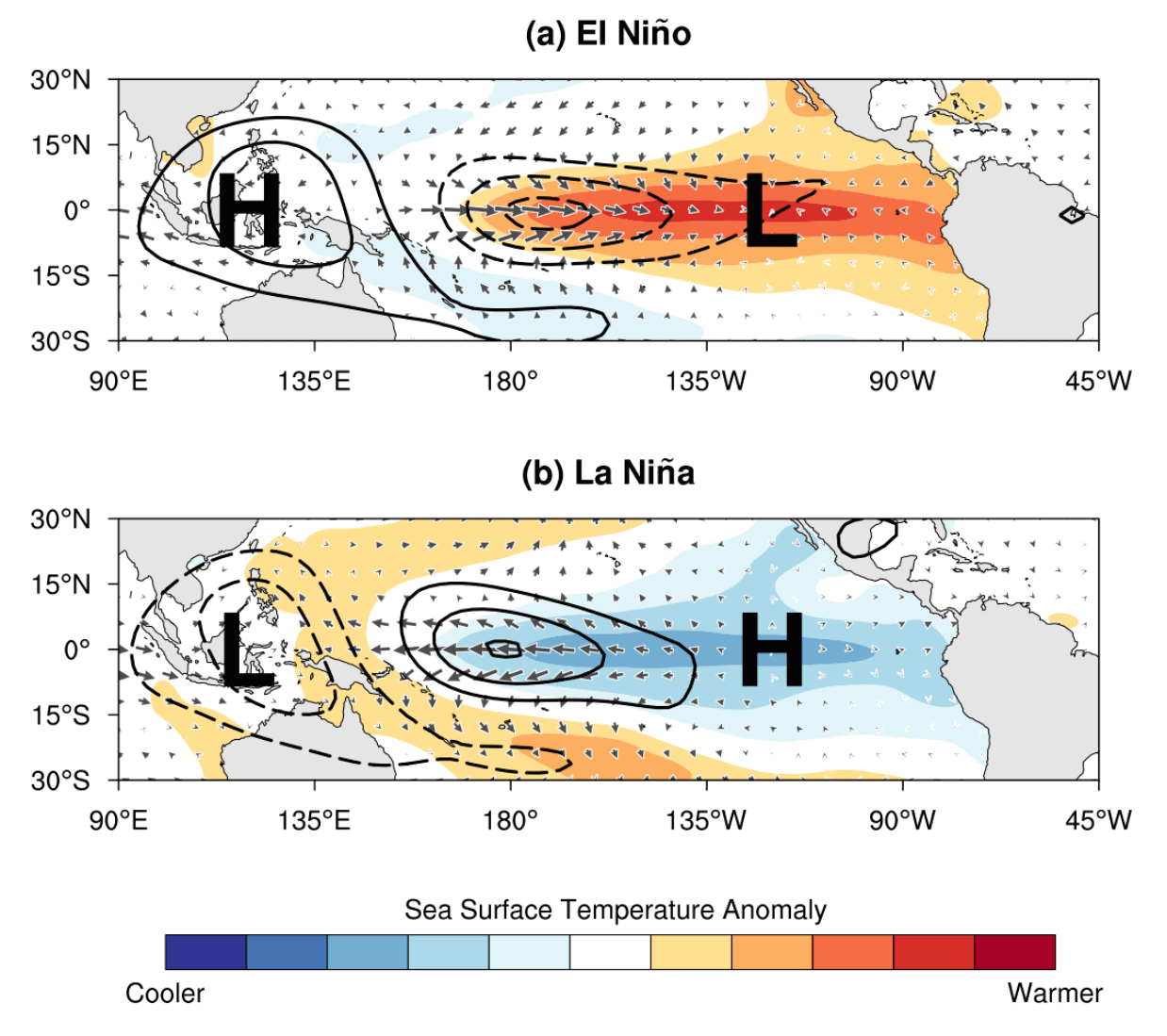

El Niño Vs La Niña

Reminder! https://www.severe-weather.eu/long-range-2/el-nino-event-development-noaa-advisory-forecast-winter-weather-impact-united-states-canada-europe-fa/ Typically there is a phase change around every 1-3 years. El Niño anomaly is growing rapidly, with a strong seasonal impact already seen in the forecast as we head into Fall and Winter 2023/2024 Based on the latest data, NOAA has released an El Niño advisory showing a rapidly growing El Niño anomaly.…

-

Should the fed declare victory?

Jeff Gundlach notes Import and Export prices, are looking encouraging. However, he also mentions that these prices are currently in negative double digits compared to previous years, indicating disinflationary pressure. Gundlach believes that the massive stimulus and economic distortions from 2020 and 2021 have led to inflation, which is still bubbling through the system. He…

-

Bianco Predicts…

The Magnificent Seven stocks (FANG stocks, plus Tesla, Microsoft, and Nvidia) have contributed significantly to the overall market gains. Bianco attributes their success to the hype around artificial intelligence and the rollout of new technologies. However, he also notes that the performance of the other 493 stocks in the S&P 500 has been less impressive,…

-

Top 15 Economies

-

Soft Landing

Mohamed El-Erian, former CEO and current academic and economic adviser, thinks that a soft landing narrative in the economy, combined with *money on the sidelines*, is driving the current rally. El-Erian acknowledges the bearish sentiment among investors but believes good earnings numbers could bring some back. *reminder…there is no such thing as money on the…

-

Canada’s 40B LNG Investment

Canada, being one of the world’s largest producers of natural gas, does not have the infrastructure to export it overseas. LNG Canada aims to become a major source of liquefied natural gas (LNG) for export. So, this project involves building a terminal and pipeline to transport the gas from the source to the terminal, where…

-

Big Bank President?

He suggests that the country’s lackluster economic growth can be attributed to shortcomings in areas such as immigration, taxation, mortgages, affordable housing, and healthcare. Dimon also discusses the need for better education and expanding the Earned Income Tax Credit as a form of industrial policy to improve social outcomes. While Dimon acknowledges his interest in…