Category: forecast

-

Kyle Bass

Kyle Bass, founder of Hayman Capital and one of the few to benefit from the 2008 mortgage crisis, warns of the concerning military capabilities of China and argues that American investors played a role in building their war machine. He points out that China now has more naval ships than the U.S. Navy and believes…

-

Blackstone forecasts….

Blackstone CFO Michael Chae sees inflation trending down and economic resilience. However, he also highlights the challenges of the cost of capital and the availability of capital, which are affected by factors like short rates, quantitative tightening ($1T annually), and credit contraction. As a result, Blackstone expects the Fed to deliver a slowdown to the…

-

2 Broke Everyone

*when you control the printing press (and there is sufficient demand)…you can do anything you want*

-

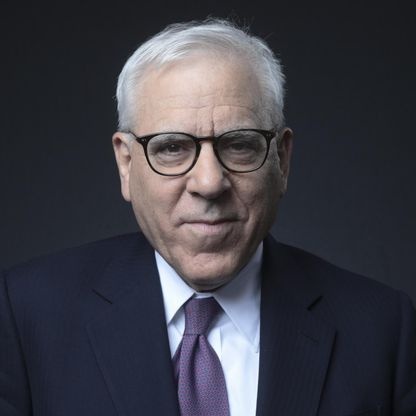

Rubenstein on Real Estate

David Rubenstein, co-founder and co-chairman of Carlyle Group, believes that the biggest investment opportunity over the next 2 to 3 years lies in the discounted real estate debt market, specifically in large commercial office buildings in major cities. Rubenstein acknowledges the challenges facing some cities, such as public relations issues and declining real estate prices,…

-

6/21/23

https://finance.yahoo.com/news/powell-nearly-all-fed-members-expect-to-raise-rates-again-this-year-123006616.html Advanced economies like the US have had a head start on developing advanced industries, making it difficult for others to catch up. Europe, despite being primarily comprised of already advanced economies, lacks the innovative global companies compared to the US and even the new players coming from Asia, with exceptions like Germany and France,…

-

6/20/23

https://media.licdn.com/dms/document/media/D4E10AQF0toTR_Tk9rA/ads-document-pdf-analyzed/0/1685027405027?e=1687798800&v=beta&t=xqj18k5NlsNOegEgJXFmm9uRJ1e1vac8jAPUp0YopdE Surprise Surprise…PIMCO likes bonds “moving away from a “TINA” world(where “there is no alternative” to equities) to one in whichbonds look cheap relative to equities. Now, bonds also appearattractive due to the current stage of the economic cycle… We maintain our underweight in equities and take a cautiousapproach, with a focus on low-leverage and…

-

Balaji Panics….

Balaji Srinivasan discusses the recent financial crisis and compares it to the one that happened in 2008. He explains that over the course of 2021, many people were saying that inflation was going to happen, but the Federal Reserve continued to sell hundreds of billions of dollars in bonds during this period. However, in December…

-

Tom Lee on 2023