Category: Hedge Fund

-

“I’d prefer crypto to have some intrinsic value.”

Martin Shkreli expresses significant skepticism regarding Michael Saylor’s enthusiastic promotion of Bitcoin, labeling it as implausible and highlighting BTC as a possible hedge to short MSTR. While acknowledging Bitcoin’s increasing institutional interest, he notes a disconnect with the average investor and underscores the need for more user-friendly transaction platforms. Shkreli conveys a bearish outlook on…

-

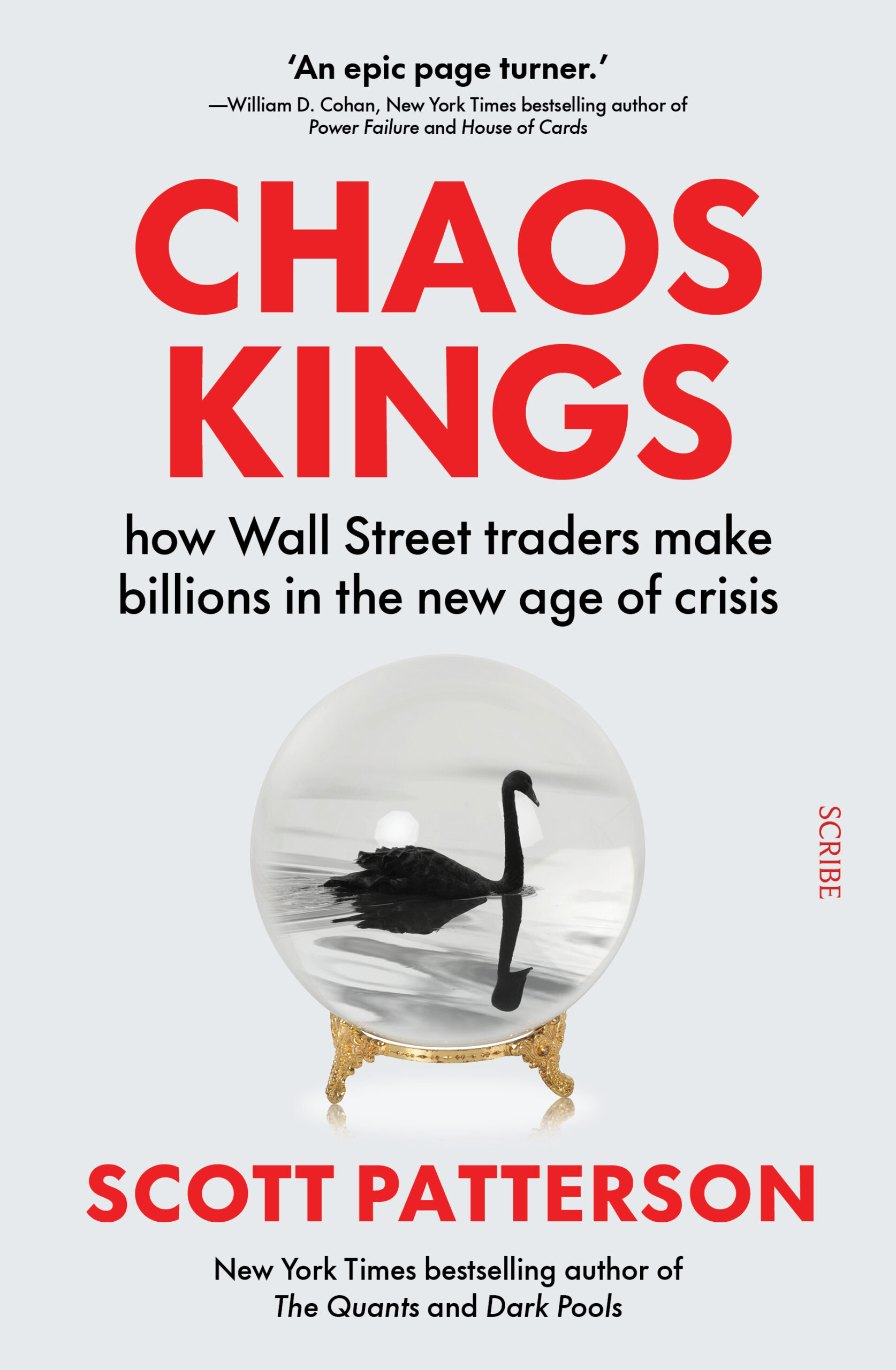

Chaos Kings

Scott Patterson’s Chaos Kings, Part 1″ YouTube video, Scott discusses his latest book inspired by Nassim Taleb and Martin Baum’s experiences during the COVID-19 pandemic. Taleb, known for his Black Swan theory, earned significant profits from Universa , his hedge fund, during the market crash. The speakers debate the existence of market timing and Universa’s investment strategy,…

-

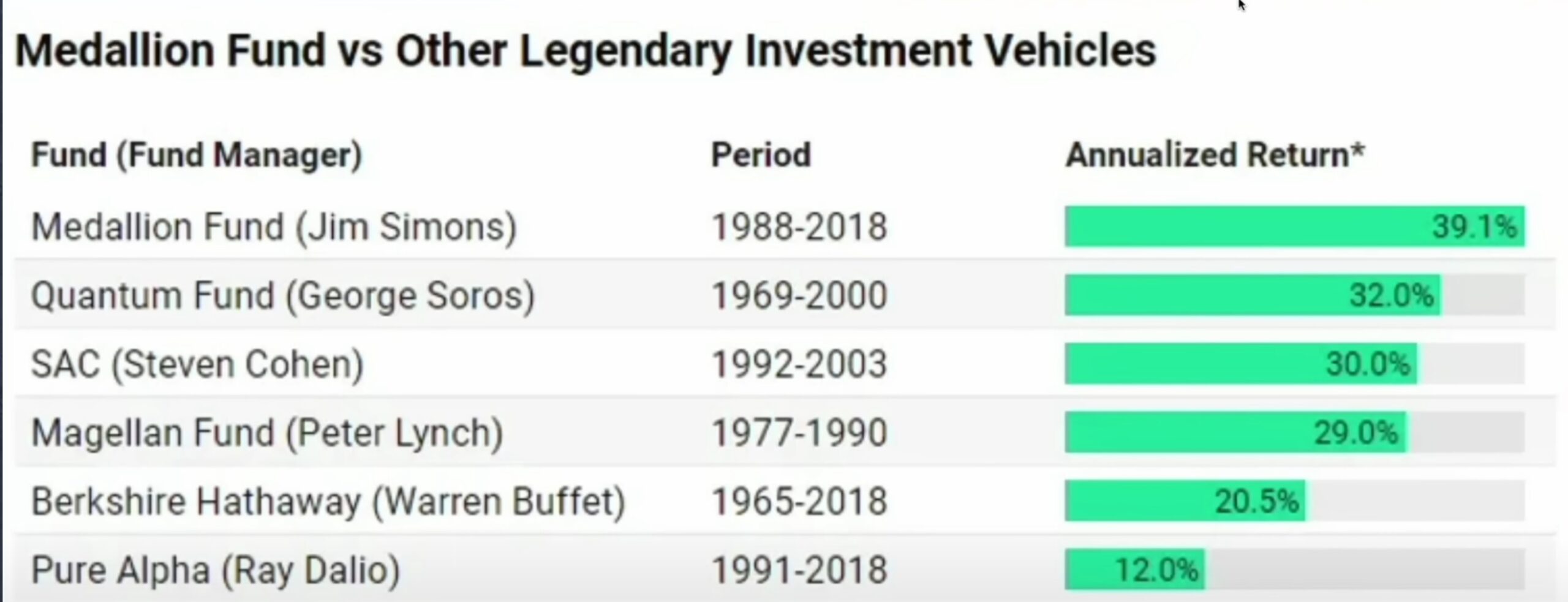

39% After Fees…

More on Jim Simons vs other great traders and investors. Also explained (by Charlie Munger) is why Medallion is/was not able to scale past 10B in AUM and some built in promo for Patrick Bet David products and services.

-

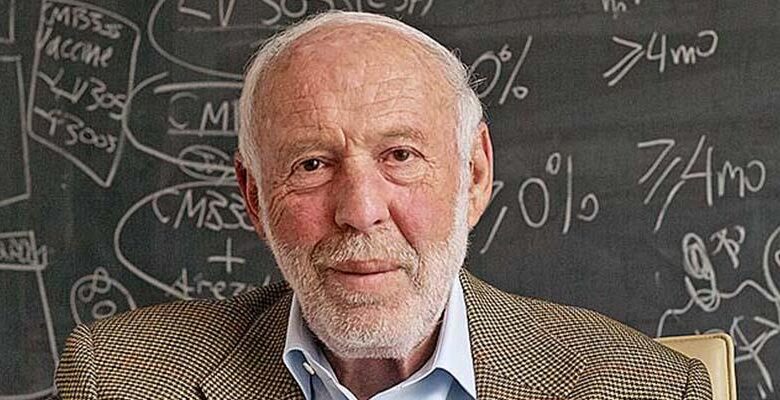

Teacher, Codebreaker, and Quant King

Jim Simons, the founder of Renaissance Technologies, is remembered for his pioneering work in quantitative investing, earning him the nickname “Quant King”. He is also recognized for his philanthropic efforts, particularly in education and mathematics, having founded a large foundation and supported other organizations, including a program to teach mathematics in grade schools and autism…

-

Lessons From the Best

Jack Schwager, author of “Market Wizards,” discusses his advice for aspiring traders in a series of YouTube interviews. He emphasizes the importance of risk management, setting stop losses, and being objective when making decisions to exit a trade. He also discusses Bruce Kovner, Michael Marcus, compares fundamental and technical trading, and indexes like the Magnificent…

-

The TV show “Billions” was based on this guy…

The documentary explores the rise and fall of Steve Cohen’s hedge fund, SAC Capital, detailing how Cohen became a legend on Wall Street, but was eventually embroiled in a multi-year federal investigation into insider trading. It covers the importance of relationships in the hedge fund industry, with traders cultivating contacts to obtain market information and…

-

The World’s Worst Person to Trade With…

Some industry executives are calling for a fresh crackdown on Former MF Global CEO Jon Corzine and a ban on his ability to trade futures. They cite his past actions and the fallout from the MF Global incident, where he oversaw the disappearance of $1 billion in customer funds. “The regulator announced a settlement with…

-

“never let a crisis go to waste”

This video highlights the emergence of catastrophe bonds, or cat bonds, as a lucrative investment opportunity in the world of Planet Finance. Cat bonds are designed to cover the damage caused by future disasters that traditional insurance companies cannot handle. The video discusses how complex computations and data analysis are used to calculate the probability…

-

Public vs. Private

Ray Dalio’s thoughts on the ongoing transfer of wealth….the link below is worth looking at just for the charts The economy is not reacting to the Fed’s tightening in the usual way, as evidenced by the data in the charts. The shift in wealth from the public sector (central government and central bank) and government…