Category: Inflation

-

A Serious Message From Buffett

Warren Buffett’s recent decisions to sell stocks (33B in last 3 quarters) and increase cash reserves ( to$147B), combined with Michael Burry’s options bet against the market, suggest concerns about a possible recession in the US economy. Factors such as persistent inflation, high gas prices, global instability, the AI boom, troubles in commercial real estate,…

-

Giving Themselves a Pat on the Back…

Cleveland Fed President Loretta Mester acknowledges that there has been stronger growth than expected, along with lower inflation and higher long-term rates, which could put downward pressure on inflation. She believes that under-tightening would be a worse mistake than over-tightening and emphasizes the importance of monitoring the economy and achieving a soft landing. Mester expects…

-

Childcare Prices are OTC

TL;DR While overall inflation has fallen significantly since last year, families with young children still face sharp increases in one of their biggest expenses-child care. Many child-care providers closed permanently early in the pandemic, and child-care prices rose more slowly than the overall inflation rate from March 2021 to February 2023, while many Americans worked from home. Childcare inflation has picked up since then as workers returning to offices fueled more demand, pay for low-wage workers jumped amid labor shortages. Congrats to our own E and R on their new baby!

-

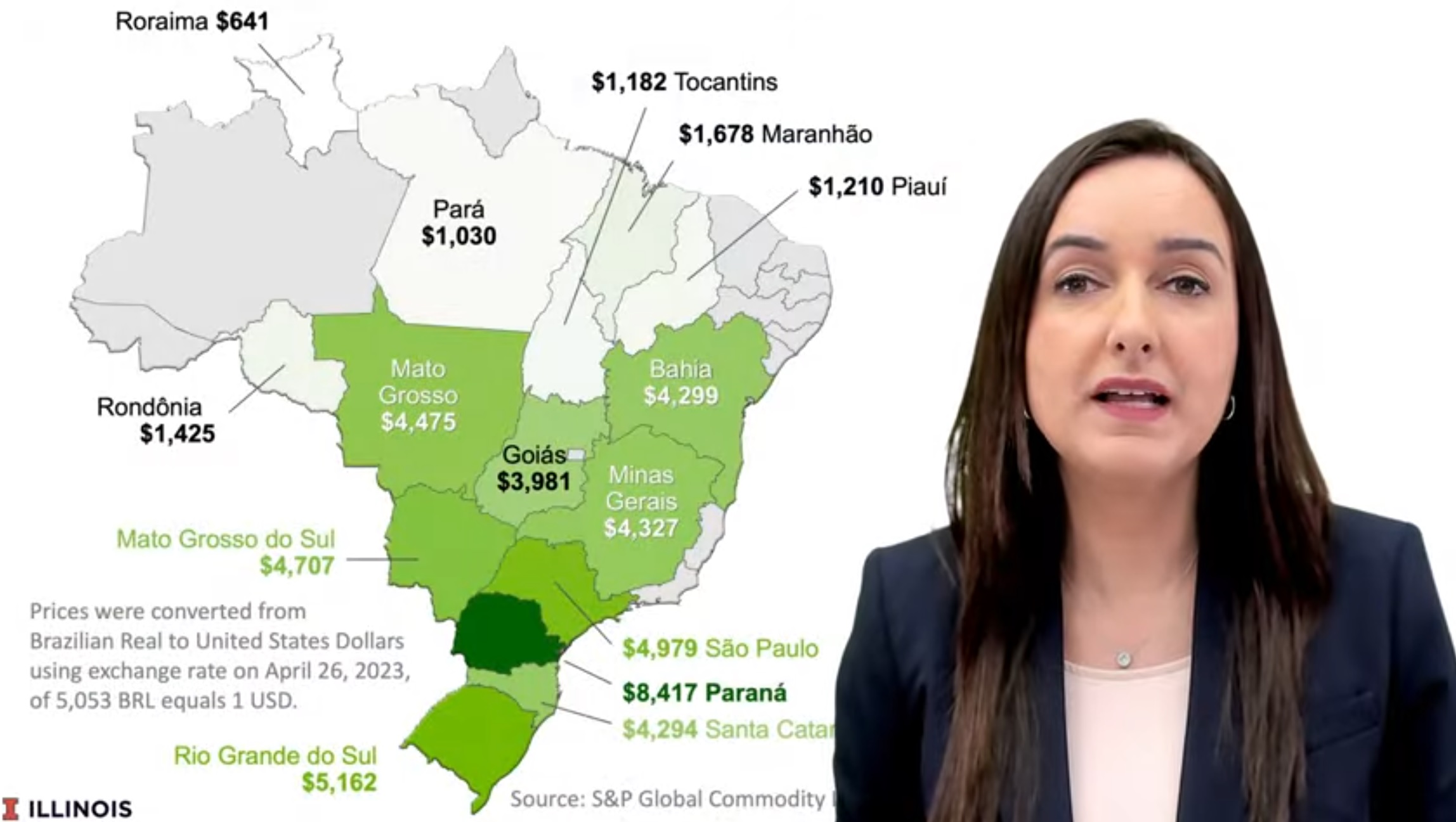

Brazilian Farmland Boom

-

Should the fed declare victory?

Jeff Gundlach notes Import and Export prices, are looking encouraging. However, he also mentions that these prices are currently in negative double digits compared to previous years, indicating disinflationary pressure. Gundlach believes that the massive stimulus and economic distortions from 2020 and 2021 have led to inflation, which is still bubbling through the system. He…

-

Bianco Predicts…

The Magnificent Seven stocks (FANG stocks, plus Tesla, Microsoft, and Nvidia) have contributed significantly to the overall market gains. Bianco attributes their success to the hype around artificial intelligence and the rollout of new technologies. However, he also notes that the performance of the other 493 stocks in the S&P 500 has been less impressive,…

-

Kyle Bass

Kyle Bass, founder of Hayman Capital and one of the few to benefit from the 2008 mortgage crisis, warns of the concerning military capabilities of China and argues that American investors played a role in building their war machine. He points out that China now has more naval ships than the U.S. Navy and believes…

-

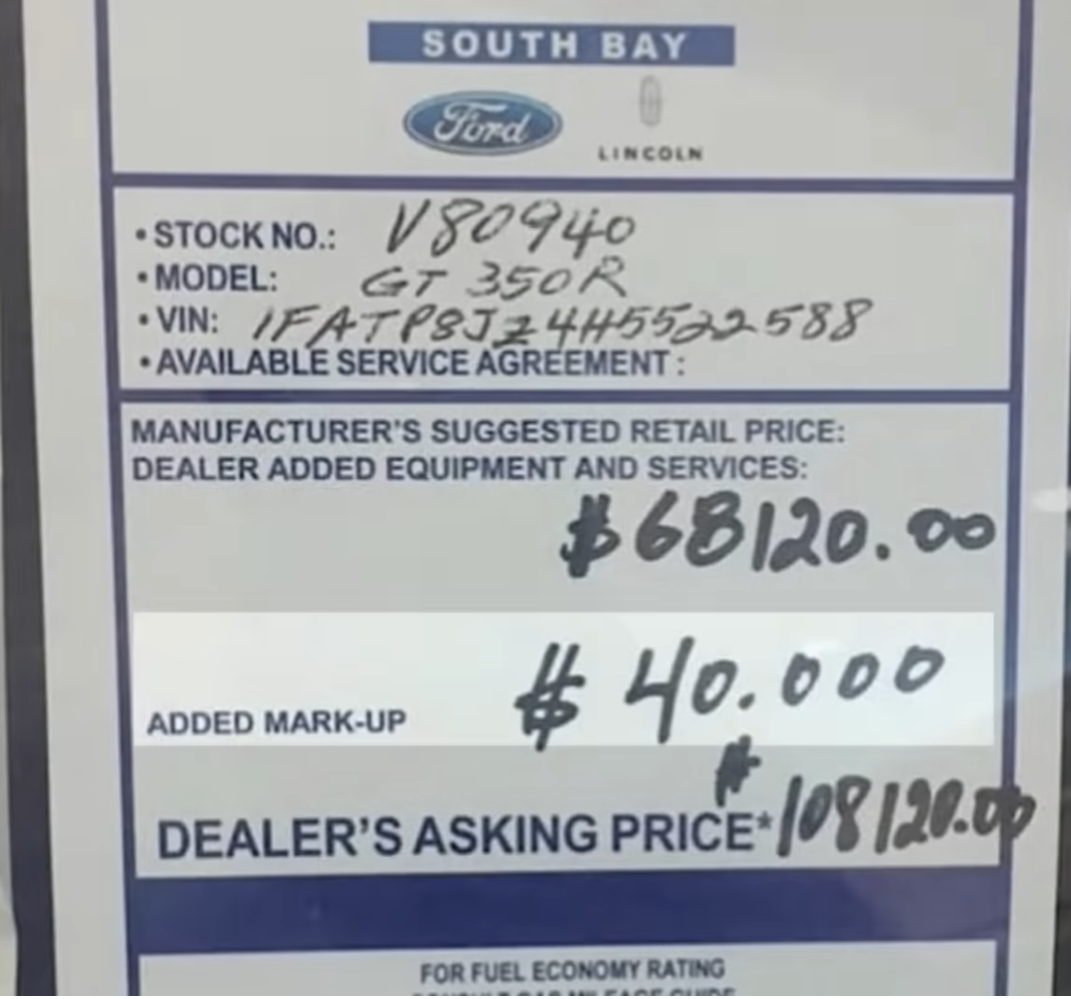

Car inflation….

One factor is the high demand for affordable transportation, which led to older cars becoming valuable commodities instead of being scrapped. As a result, there are fewer average cars available for the middle class. The high-price, high-margin models received first priority and pick of the limited semiconductors supply sourced from China. Car manufacturers and dealers…

-

69

University of Michigan’s final consumer sentiment reading for June is reported at 64.4, making it the second-best reading of the year. Current conditions also improved to 69, the second-best reading outside of February. Inflation numbers remained steady, with a one-year inflation rate of 3.3 and a 5 to 10-year inflation rate of 3.0, both being…