Category: Investing

-

Balaji Panics….

Balaji Srinivasan discusses the recent financial crisis and compares it to the one that happened in 2008. He explains that over the course of 2021, many people were saying that inflation was going to happen, but the Federal Reserve continued to sell hundreds of billions of dollars in bonds during this period. However, in December…

-

6/14/23

FED DAY!!! Policy announcement at 1CST, press conference at 1:30 https://finance.yahoo.com/news/fed-expected-to-skip-a-june-rate-hike-but-signal-more-in-the-future-141346398.html The Fed’s benchmark interest rate stands in a range of 5%-5.25%, the highest level since September 2007. As part of its most aggressive rate hiking campaign since the 1980s, the Fed has increased the target range for its benchmark interest rate by 5 percentage…

-

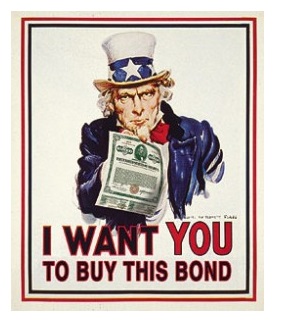

Time For Bonds

https://finance.yahoo.com/news/jpmorgan-michele-says-time-exit-143330550.html I don’t agree with this but…… it’s interesting to read what the other side thinks….. JPMorgan’s Michele Says It’s Time to Exit ‘Cash Trap’ and Move Into Bonds JPMorgan’s Michele Says It’s Time to Exit ‘Cash Trap’ and Move Into Bonds (Bloomberg) — It’s time to exit the “cash trap” of money market funds…

-

Gundlach on Macro

-

6/12/23

Nassim Taleb, hedge fund manager and author of “The Black Swan” discusses the limitations of financial models. He argues that most of the world is driven by Fat-Tailed processes and that using normal distributions in risk analysis is not accurate. Taleb explains that Modern Portfolio Theory, which uses a mix of stocks and bonds, does…

-

Druckenmiller on AI

Investor Stanley Druckenmiller shared his concerns about the US national debt and entitlement spending, warning of the strain on America’s GDP and future investment and innovation. He also discussed the potential risks in asset markets, tightening credit, and problems in banks due to the Fed’s encouragement to buy treasuries, and he believes a hard landing…

-

Change is the Only Constant

Warren Buffett discusses the importance of adapting to change in business. He notes that Berkshire Hathaway has diversified its portfolio in response to changes that hurt some of its founding businesses. Buffett advises expanding one’s knowledge but warns not to force it and recommends continuous learning and adaptation within one’s own circle of competence. Buffett…