Category: Jay Powell

-

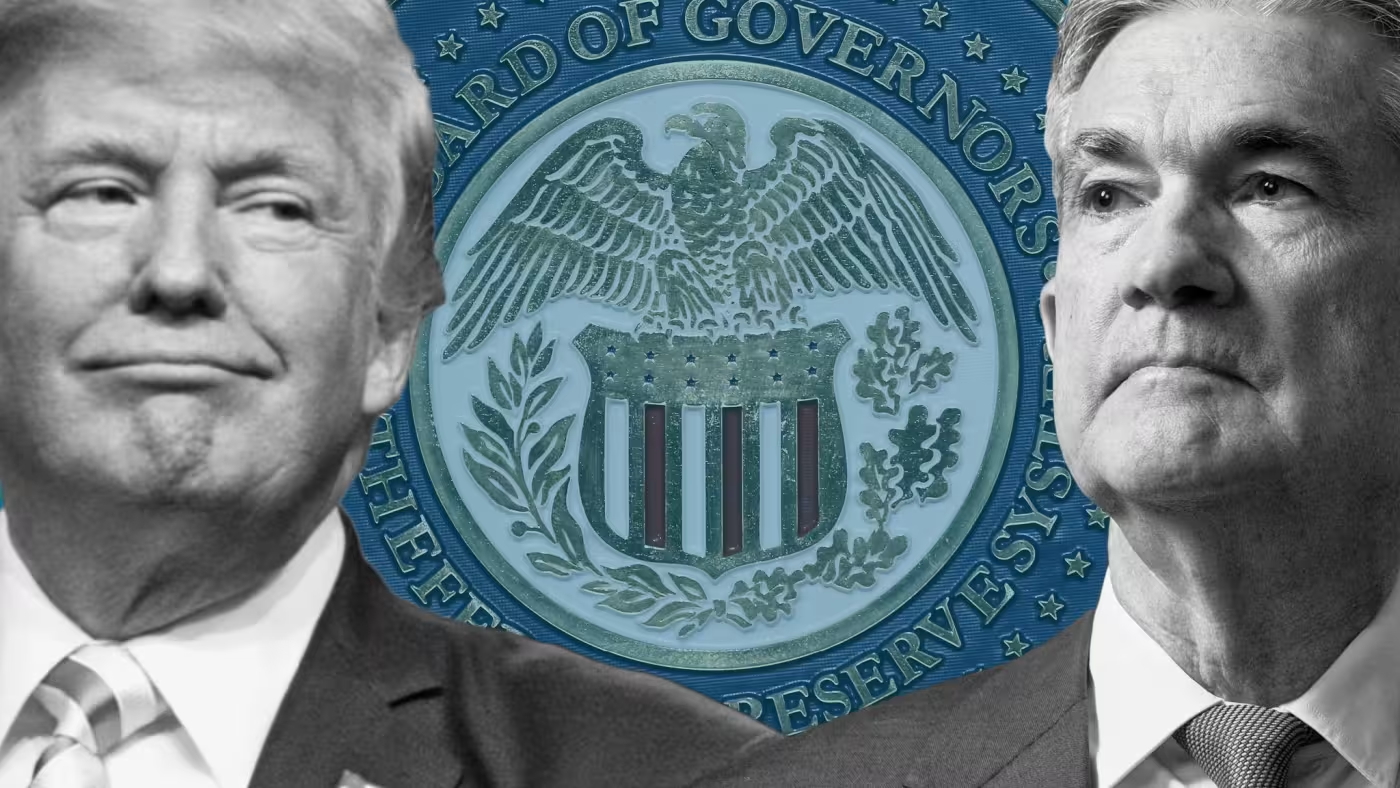

Fed Chair vs. The World

Speech starts at 10:45 Jerome H. Powell, Chair of the Federal Reserve, addresses the Economic Club of Chicago, discussing the current economic outlook and the Fed’s dual mandate of maximizing employment and ensuring price stability. Powell outlines the resilience of the U.S. economy despite heightened uncertainties, acknowledging challenges arising from trade policy changes, inflation concerns linked…

-

Kyle Bass

Kyle Bass, founder of Hayman Capital and one of the few to benefit from the 2008 mortgage crisis, warns of the concerning military capabilities of China and argues that American investors played a role in building their war machine. He points out that China now has more naval ships than the U.S. Navy and believes…

-

Econ 101?

Senator Kennedy questions Federal Reserve Chairman Jerome Powell about inflation and capital requirements for banks. **Powell explains that we had very little inflation for 25 years** and that inflation depends on whether tax increases or spending cuts are part of a congressional budget plan. If there were no spending cuts, he believes there would be…

-

Rubenstein on Real Estate

David Rubenstein, co-founder and co-chairman of Carlyle Group, believes that the biggest investment opportunity over the next 2 to 3 years lies in the discounted real estate debt market, specifically in large commercial office buildings in major cities. Rubenstein acknowledges the challenges facing some cities, such as public relations issues and declining real estate prices,…

-

BTC “Staying Power”

The inaugural Coinbase State of Crypto Summit was focused on regulation and the macro landscape, with institutional investors, corporations, policymakers, and academics in attendance. The sentiment in the industry has been high since BlackRock filed for a spot Bitcoin ETF, signaling that it sees a place for Bitcoin in an investment portfolio. Additionally, Fed chair…

-

Balaji Panics….

Balaji Srinivasan discusses the recent financial crisis and compares it to the one that happened in 2008. He explains that over the course of 2021, many people were saying that inflation was going to happen, but the Federal Reserve continued to sell hundreds of billions of dollars in bonds during this period. However, in December…

-

JUNE FOMC

https://assets.realclear.com/files/2023/06/2201_fomc.pdf June FOMC Meeting: Saying They Will If They Have To, But Hoping They Won’t Have To? › The FOMC made no change to the Fed funds rate target range, leaving the mid-point of the target range at 5.125 percent › The updated dot plot implies a terminal Fed funds rate target range mid-point of…

-

Fed Day

https://finance.yahoo.com/news/fed-expected-to-skip-a-june-rate-hike-but-signal-more-in-the-future-141346398.html The Fed’s benchmark interest rate stands in a range of 5%-5.25%, the highest level since September 2007. As part of its most aggressive rate hiking campaign since the 1980s, the Fed has increased the target range for its benchmark interest rate by 5 percentage points since March 2022.

-

Fake News

this is fake news because the big mac price is really 5 something but the message is directionally accurate. Inflation hurts Mcdonald’s customers the most. Personally, my last McDonalds order was $15+.

-

Fed Leanings….

https://finance.yahoo.com/news/why-the-feds-rate-decision-will-likely-be-a-last-minute-call-105028772.html Powell has been careful not to tip his hand, along with New York Fed President John Williams, Richmond Fed President Tom Barkin, San Francisco Fed President Mary Daly, Chicago Fed President Austan Goolsbee, and Fed Governor Chris Waller, who have also signaled to keep their options open. “Inflation is not as low as they…