Category: outlook

-

JPMORGAN Outlook Q2

Via their Q2 update: https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets

-

Griffin at Goldman

-

Tom Lee on 2023

-

JUNE FOMC

https://assets.realclear.com/files/2023/06/2201_fomc.pdf June FOMC Meeting: Saying They Will If They Have To, But Hoping They Won’t Have To? › The FOMC made no change to the Fed funds rate target range, leaving the mid-point of the target range at 5.125 percent › The updated dot plot implies a terminal Fed funds rate target range mid-point of…

-

Dalio’s World

Ray Dalio and Thomas Friedman discuss China’s Confucianism way of thinking and how it affects China’s foreign policy. China views itself as a family and its country as an extended family. Confucianism is a top-down, hierarchical philosophy based on strict parenting. They focus on mutual respect between those who are more powerful and those who…

-

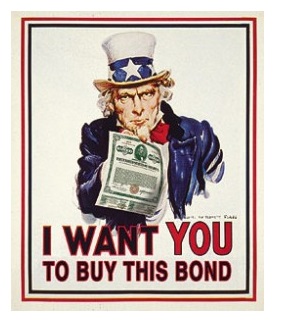

Time For Bonds

https://finance.yahoo.com/news/jpmorgan-michele-says-time-exit-143330550.html I don’t agree with this but…… it’s interesting to read what the other side thinks….. JPMorgan’s Michele Says It’s Time to Exit ‘Cash Trap’ and Move Into Bonds JPMorgan’s Michele Says It’s Time to Exit ‘Cash Trap’ and Move Into Bonds (Bloomberg) — It’s time to exit the “cash trap” of money market funds…

-

Fed Day

https://finance.yahoo.com/news/fed-expected-to-skip-a-june-rate-hike-but-signal-more-in-the-future-141346398.html The Fed’s benchmark interest rate stands in a range of 5%-5.25%, the highest level since September 2007. As part of its most aggressive rate hiking campaign since the 1980s, the Fed has increased the target range for its benchmark interest rate by 5 percentage points since March 2022.

-

Gundlach on Macro