Category: Ray Dalio

-

Hope

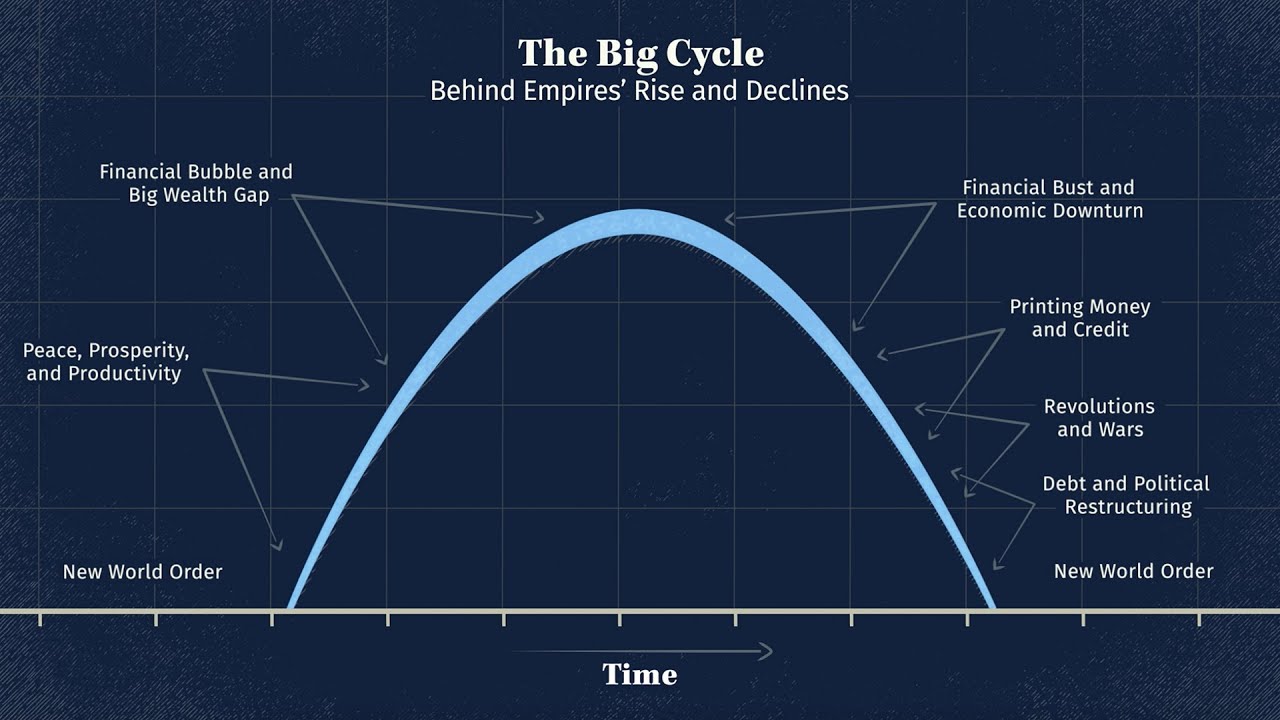

Ray Dalio and David Friedberg hope bringing attention to the US debt problem will help the government gather the courage to cut spending. Ray highlights the historical context of debt cycles and the importance of understanding patterns in financial trends to avoid severe economic crises, underlining that many currencies have faced devaluation over time. Dalio…

-

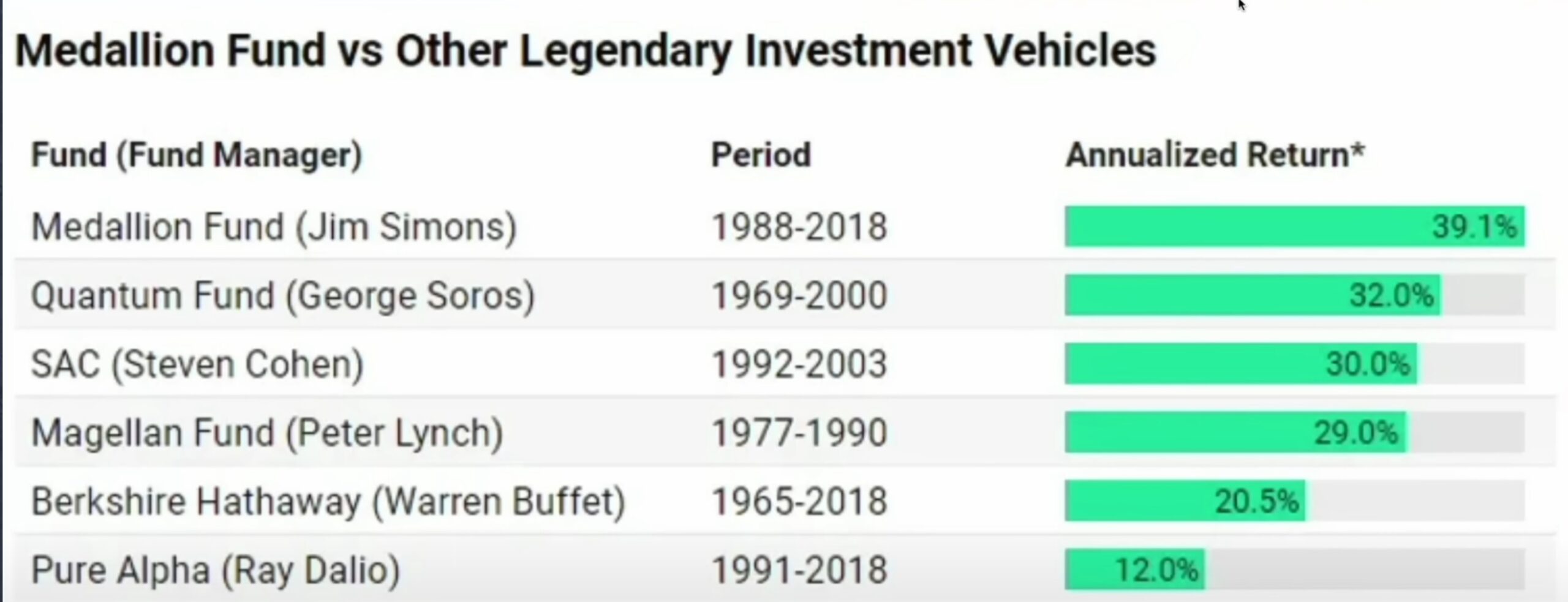

39% After Fees…

More on Jim Simons vs other great traders and investors. Also explained (by Charlie Munger) is why Medallion is/was not able to scale past 10B in AUM and some built in promo for Patrick Bet David products and services.

-

Board of Changemakers: FII

The main themes outlined in the video include the challenges and opportunities posed by the shift towards renewable energy, technological trends impacting productivity and economic growth, the need for hard-nosed leadership in navigating real-world issues, and the potential challenges facing various industries, such as banking and finance, and commercial real estate. The video also touches…

-

Dalio

Ray Dalio, in his talk at the All-In Summit, focuses on the rise and fall of nations and the changing world order. He highlights the importance of studying history to understand the patterns and drivers of societal shifts. Dalio identifies three significant factors that are shaping the current world order: debt and money creation, internal…

-

Public vs. Private

Ray Dalio’s thoughts on the ongoing transfer of wealth….the link below is worth looking at just for the charts The economy is not reacting to the Fed’s tightening in the usual way, as evidenced by the data in the charts. The shift in wealth from the public sector (central government and central bank) and government…

-

Dalio’s World

Ray Dalio and Thomas Friedman discuss China’s Confucianism way of thinking and how it affects China’s foreign policy. China views itself as a family and its country as an extended family. Confucianism is a top-down, hierarchical philosophy based on strict parenting. They focus on mutual respect between those who are more powerful and those who…

-

Dalio Says STAGFLATION

Dalio Says STAGFLATION Ray Dalio discusses how the problem with the US’s current debt crisis is that the central banks and the commercial banks will have solvency concerns due to government debt holdings. He highlights the trade-off between raising the debt-to-income ratio and balancing interest rates for creditors rather than debtors. He adds that the…