Category: SPY

-

To Short or Not to Short

Market Speculation and Valuation 🚀The S&P 500 trading at 23 times next year’s earnings is extremely overextended, signaling potential market overvaluation and speculative behavior. 💡Earnings mean reversion poses a significant risk, as historically high corporate margins could halve earnings if they revert to mean levels. 🎢The MNAV premium in Bitcoin, currently at 2.25x, has historically reached 300% before collapsing, indicating extreme retail speculation and market…

-

Pain…

BCA Research’s Peter Berezin says the worst is yet to come for stocks and he sees the S&P 500 falling to 4,450 by year-end. And he says that call may still be too bullish. He was one of the few to accurately predict a correction this year. Personally, I think he’s right and do not…

-

Mike Green on “Passive”

The causes, risks, and future related to passive investing and its influence on the markets. In summary Mike has quantified 1) the effects of regulatory and QDIA changes as well as 2) value managers being fired and passive managers being hired. https://www.simplify.us/leadership

-

JPMORGAN Outlook Q2

Via their Q2 update: https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets

-

Siegel is a Bull

Professor Jeremy Siegel expresses optimism about the economy’s strength, despite high interest rates. The Atlanta Fed’s revised GDP estimate for the first quarter surpassing 2% is an indicator of a healthier economy. While some sectors, such as tech, may be overvalued, the majority of the market is reasonably priced at around 17 times forward earnings.…

-

Bianco on Risk

-

Short & Co.

-

2024 Predictions

-

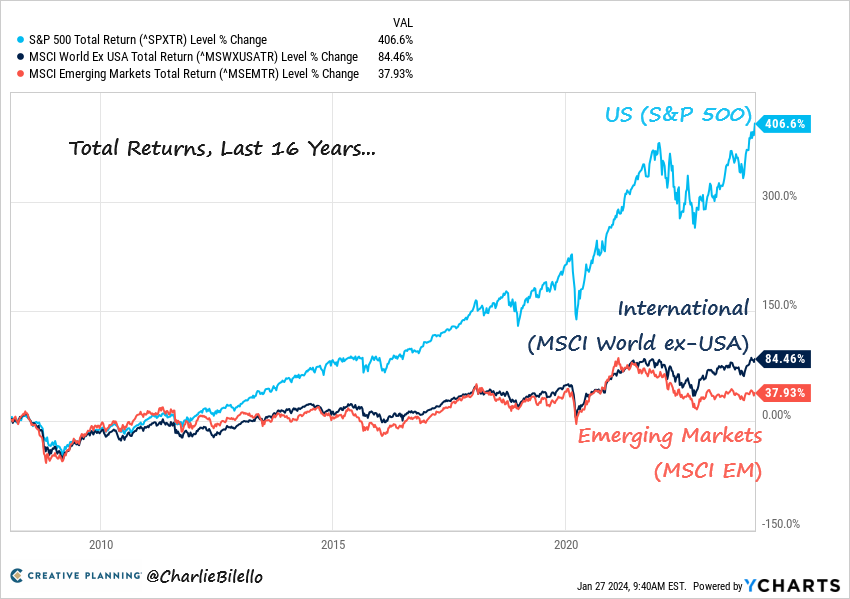

S&P vs The World