Category: Warren Buffett

-

“I don’t think it’s time to get out…

…It’s a matter of relative choices.” “No. 1, what’s going to happen? Nobody knows. His appointments are not firm, they have yet to be confirmed. his policies are not known. What is he going to do? Nobody really knows what he’s going to do? No. 2, What else will be going on in the world.…

-

Li Lu

Li Lu and Charlie Munger and Warren Buffett,” the speaker shares experiences and insights from meetings and mentorships with Charlie Munger and Warren Buffett. Munger, initially perceived as distant, provided valuable advice and encouraged long-term investment strategies. Buffett admired Munger’s ability to understand complex businesses and expand his investment horizons. Li Lu, a Chinese businessman,…

-

Short Volatility Callers

-

Why 2% Succeed. Lessons from Warren Buffett

Buffett expresses his belief in investing only in things he understands and shares his experience with evaluating businesses based on their economic characteristics. He uses examples of industries like automobiles and airplanes to illustrate how difficult it is to predict winners and emphasizes the importance of understanding the economic consequences of a business. Buffett shares…

-

Explainer…

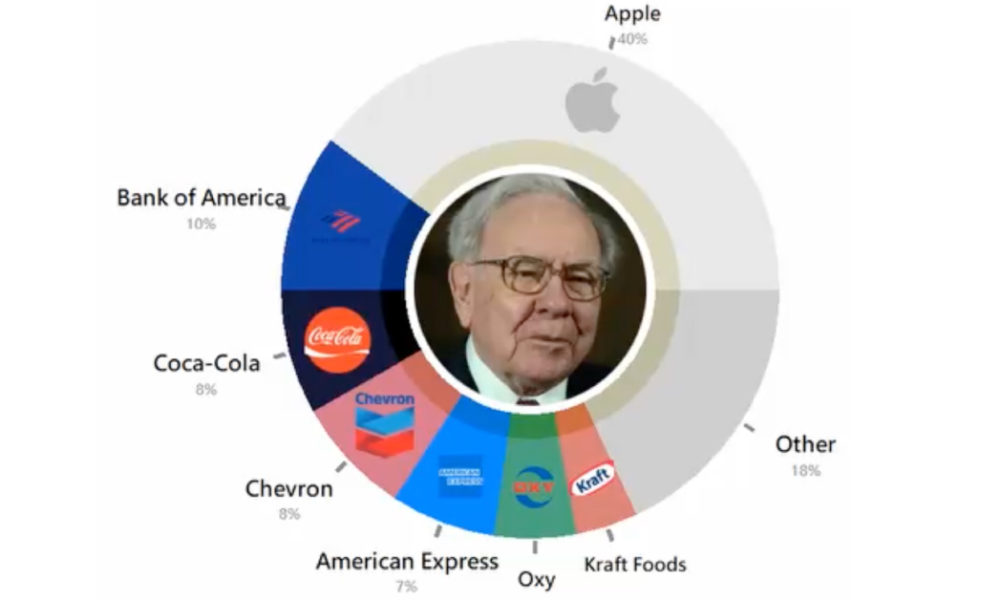

The Nikkei index experienced its second biggest decline in history, and the unwinding of carry trades and the Bank of Japan’s ultra-easy monetary policy were identified as primary reasons for the selloff. Buffett’s Berkshire Hathaway recently increased its cash holdings and sold a significant portion of Apple stock, leading to concerns about his bearish outlook…

-

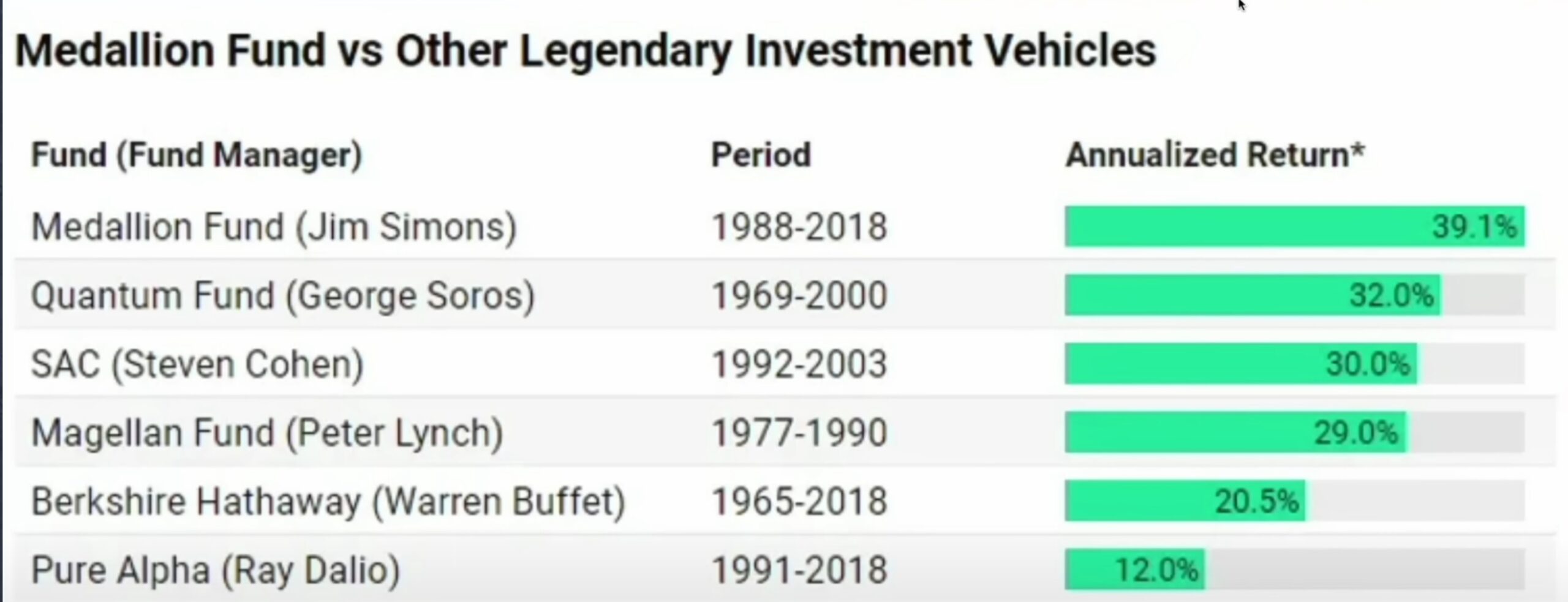

39% After Fees…

More on Jim Simons vs other great traders and investors. Also explained (by Charlie Munger) is why Medallion is/was not able to scale past 10B in AUM and some built in promo for Patrick Bet David products and services.

-

Turning 1M into 1B

“Turning $1M Into $1B+: A Masterclass From The Indian Warren Buffet”. Mohnish shares various insights from his experiences and encounters with Warren Buffet and Charlie Munger. One of these experiences involved winning a lunch with Buffet but having a friend who couldn’t pay, leading to a meeting with Munger instead. The speaker developed a deep…

-

Buffett Locking in Gains

Buffett clarified that this does not reflect a change in view towards Apple’s business or investment attractiveness. Berkshire considers various factors, including tax implications and manager responsibility, when deciding on stock investments. Buffett emphasized that they do not attempt to predict markets or pick stocks based on trends but view them as businesses to serve…

-

Charlie Munger