-

Thiel

Peter Thiel, a renowned Silicon Valley investor known for co-founding PayPal and Facebook, and backing companies like SpaceX and Stripe. Thiel emphasizes the importance of Founders and their unique visions, contrasting the 1990s Silicon Valley trend of replacing Founders with professional CEOs. He discusses his book “Zero to One,” which highlights the significance of creating something new…

-

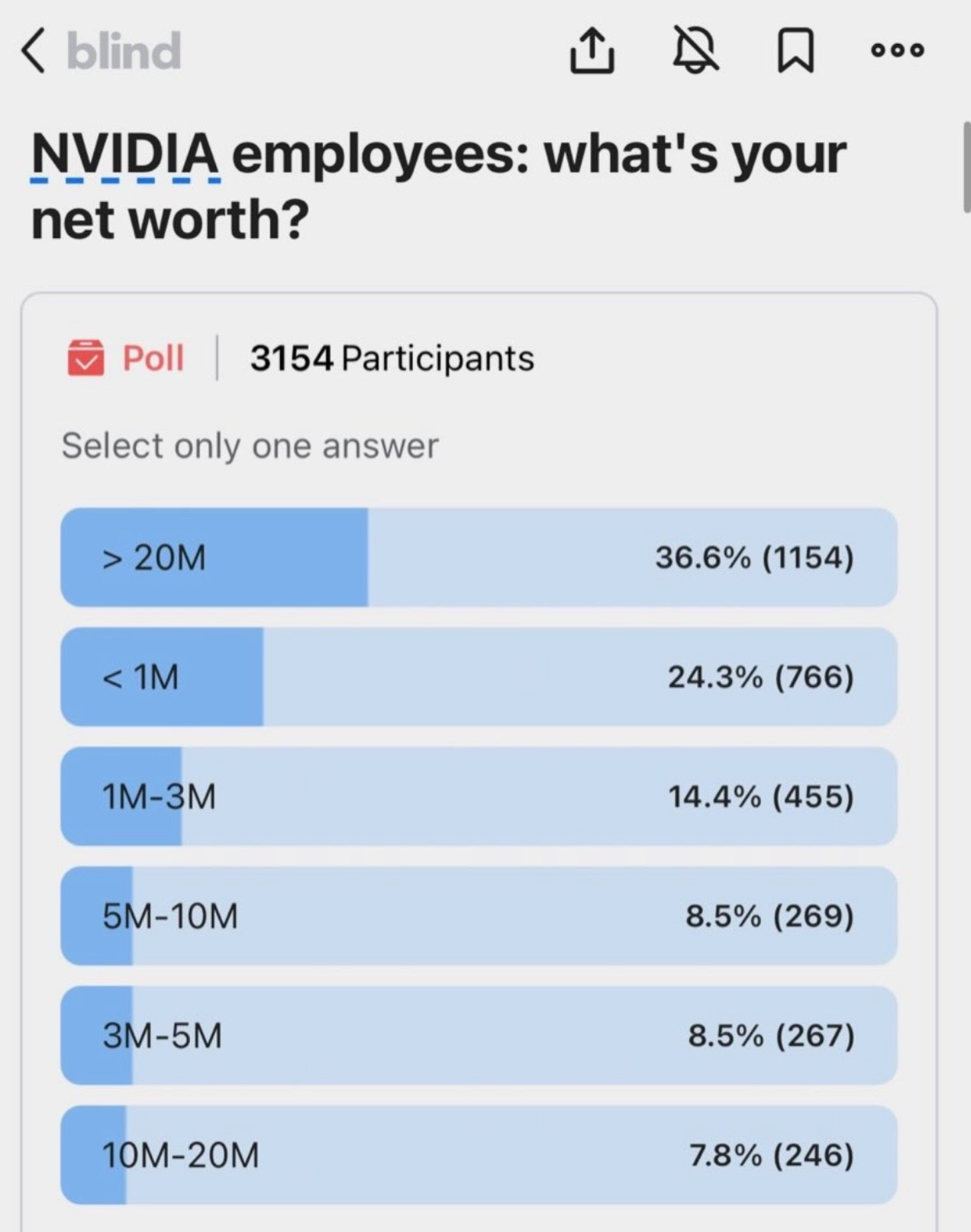

NVIDIA Millionaires

-

Who’s Ready to Trade All Night?

The NYSE is conducting a survey to gauge demand for overnight trading and is considering the necessary infrastructure changes. Robin Hood, Interactive Brokers, and other platforms already offer after-hours trading, with significant growth in overnight transactions. However, challenges such as central clearing and settlement, market manipulation, and resistance from market participants remain. The opening bell ceremony…

-

Supercomputer Wars: Tesla vs. Nvidia

Tesla’s supercomputer project, Dojo, is a powerful and bespoke hardware platform designed by Tesla’s AI division for training computer vision and full self-driving networks. Dojo uses a system on a chip called the Dojo chip, which integrates 25 chips to create one unified system. Tesla is also using wafer scale processing to create large, single-chip supercomputers,…

-

Up, we win. Down, you lose…

Lehman Brothers, a prosperous investment bank founded in 1850, was at the height of its success in 2006 with revenues totaling $19 billion and over 25,000 employees. However, the bank’s aggressive expansion and risky lending practices, particularly in the housing market, led to the financial crisis of 2008. When Bear Stearns became the first victim…

-

Trading Cities…

Famous youtuber explains why he moved from NYC to New Jersey.

-

Never Say Never

Cliff Asness, founder of AQR Capital Management, discusses his views on market efficiency. Asness recalls his experience in Eugene Fama’s efficient market theory class, where he learned that markets are not perfectly efficient, causing a gasp among students. He explains that while markets are more efficient than he believes, perfect efficiency is an unrealistic concept.…

-

Market Concentration

(from 2 years ago) (from this week) While this topic makes for great clickbait it’s just another variation of the “this time is different” argument. Concentration is not new or different. Vilfredo Pareto noted this a long time ago. https://www.masterclass.com/articles/pareto-principle-explained Right or wrong….If an index is “too concentrated” how about we just keep cash on…

-

With Flying Colors…

The spectacular results of the Federal Reserve’s stress tests on the eight largest banks. Every single one of the top 31 banks passed the tests despite holding more consumer credit card loans and corporate debt, with elevated delinquency rates and retail giants reporting that consumers are tapped out. The Fed also performed an exploratory analysis…

-

Artificial Intelligence Bubble

An opinion from a sleazy but credible market participant. Shkreli draws parallels between the dotcom bubble of the late 1990s and the current hype surrounding artificial intelligence (AI). He believes that the potential valuations of AI companies may lead to a bubble, but the long-term value may come from companies that emerge after the bubble bursts. Shkreli…

Got any book recommendations?