Tag: Interest Rates

-

Outlook for the Economy

-

Bank of America Losses

131.6 Billion. Ouch

-

Hot Developer in Hot Water

StoryBuilt is up for sale with an estimated value of $2 billion, including projects in some of the highest-growth markets in the United States. A&G Real Estate Partners and Onyx Asset Advisors said they are looking to sell 28 developments in various stages of planning or completion in Austin, Texas; Dallas; Denver; and Seattle by…

-

7 to 108 Billion

Howard Marks discusses the upcoming sea change in financial markets and the potential implications for investors. He highlights the shift from declining or ultra-low interest rates to a higher interest rate environment, stating that credit instruments may provide equity-like returns and become more attractive. Marks reflects on his career at Oaktree and the growth of…

-

Prices Are Still Too High

According to WSJ, many Americans continue to fixate on inflation, despite the fact that prices are rising more slowly. This discontent with inflation is weighing on President Biden’s approval ratings and his re-election hopes. Although inflation has fallen, it remains a significant concern for consumers. They are particularly sensitive to rising prices because they remember…

-

How to Commit Fraud

The video explains how Olympus executives engaged in fraudulent practices such as inflating the company’s books, buying companies at inflated prices, and using off-balance sheet entities to hide losses. Michael Woodford, a British businessman working at Olympus, noticed the irregularities and raised suspicions, eventually becoming CEO and uncovering the fraud. However, he was abruptly fired…

-

“Well Publicized Trouble”

Kimball Brooker Jr. of First Eagle explains how uncertainty around Chinese economic growth has impacted global equity markets and why the Global Value team is maintaining a cautious outlook as the yield curve remains inverted. https://www.firsteagle.com/insights/september-views-first-eagle-global-value-team-0 https://www.dataroma.com/m/holdings.php?m=FE

-

Bianco Predicts…

The Magnificent Seven stocks (FANG stocks, plus Tesla, Microsoft, and Nvidia) have contributed significantly to the overall market gains. Bianco attributes their success to the hype around artificial intelligence and the rollout of new technologies. However, he also notes that the performance of the other 493 stocks in the S&P 500 has been less impressive,…

-

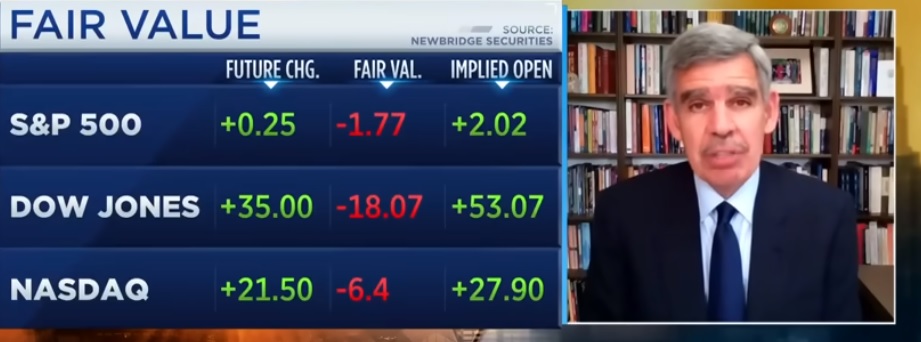

Soft Landing

Mohamed El-Erian, former CEO and current academic and economic adviser, thinks that a soft landing narrative in the economy, combined with *money on the sidelines*, is driving the current rally. El-Erian acknowledges the bearish sentiment among investors but believes good earnings numbers could bring some back. *reminder…there is no such thing as money on the…